Unleashing the Financial Revolution: A Deep Dive into the World of Decentralized Finance

In the burgeoning world of cryptocurrencies and blockchain technology, the term “Decentralized Finance” (DeFi) takes on a pivotal role. DeFi represents a novel movement that challenges the traditional financial system by leveraging blockchain technologies. The concept is simple yet revolutionary: the elimination of intermediaries and enabling transactions that occur directly between parties, secure and transparent.

The concept of DeFi isn’t new. However, while Bitcoin opened the door to decentralized digital currencies, DeFi expands this framework to create an entire decentralized financial ecosystem. This encompasses a wide range of financial services – including, but not limited to, lending, insurance, and asset trading.

I spoke with Simon Molitor, the co-founder of the DeFi startup digitalsocial.id, about the current developments in the DeFi market and the potential of this emerging movement:

Philipp: Can you explain DeFi to us in simple terms?

Simon: Decentralized Finance (DeFi) aims to replicate traditional financial services without the need for intermediaries. The idea can be traced back, among other things, to the Bitcoin Whitepaper that, in 2008, explained the concept behind Bitcoin on both an ideological and technical level. Regarding DeFi, the Bitcoin maxim “Verify – don’t trust” is particularly applicable: here, the still-anonymous author of the Bitcoin Paper refers to the principle of viewing code as law instead of trusting the laws of the “old world”. The basic idea, therefore, is to offer secure financial services that are purely monitored by code. This is where blockchain comes into play.

Distributed Ledger Technology (DLT) describes the technology behind decentralized databases that are not operated by a central entity but by a network of many computers (or “nodes”). This ensures that a) power relations are distributed evenly and decentralized and b) data is irrevocably stored due to the “chain” in the blockchain. Once stored on the blockchain and confirmed by all computers in the network, a transaction cannot be reversed.

The graphic shows the technical prerequisites for DeFi and how the various technical layers interact, and how different applications are categorized within this framework.

DeFi Stack by Cristina Hernando, DeFi Talents Cohort 05

Philipp: Why do you think DeFi is gaining importance?

Simon: I believe that luck is what happens when preparation meets opportunity: Distributed Ledger Technology, cryptography, and thus DeFi were fortunate to be at the right place at the right time. The window of opportunity was open. Following the 2008 financial crisis, enough early adopters were able to gather in internet forums, who were interested enough in a “shadow financial system” to continue working on its realization. And so the first applications were developed that used cryptography to eliminate intermediaries and realize peer-to-peer transactions in finance.

Today, additional global tensions and an accelerated financial inequality are creating an environment conducive to building a decentralized financial system. When we talk about the advantages of DeFi, it also becomes clear why the idea is gaining momentum.

DeFi offers very clear advantages compared to the traditional financial world: DeFi is still largely “permissionless” – a term often used in the DeFi area. This reflects the fact that any person on the planet with an internet connection is able to use DeFi services. There is no discrimination based on nationality, color, gender, age, or other attributes.

Ultimately, DeFi enables anonymous or pseudonymous financial transactions on the internet, which for the proponents of DeFi technology is a central human right.

It’s important to mention: of course, every mentioned advantage comes with a counter-argument. But rest assured, for every possible objection that may come to mind, there is at least one highly talented team working on it.

Philipp: Was it solely DLT technology that was key to this, or are there other drivers?

Simon: The blockchain itself is certainly the central technological element that drives cryptocurrencies, Decentralized Finance, and all other Web 3.0-specific ideas. On a technological level, however, we can delve even deeper and say that the open-source nature of many blockchain apps also leads to accelerated adoption. Many projects are completely transparent in their code base, allowing developers from around the world to participate in projects and ensure rapid progress. Or applications are “forked”, which simply means “copied”: a team takes it upon themselves to rethink an already active project and build on its code to release an improved version.

Another level below DLT itself are Smart Contracts. Smart Contracts are digital contracts with which agreements can be made between people or companies. They are called “smart” because they can automatically do things without someone having to check and ensure that everything is done correctly – code is law. For example, Bitcoin is a blockchain that does not bring Smart Contract functionality, while Ethereum natively supports this function. This has resulted in Bitcoin not hosting any significant applications on its blockchain today. Ethereum, on the other hand, is home to the most financially extensive DeFi projects.

Philipp: In which areas do you see the greatest potential for DeFi in the future?

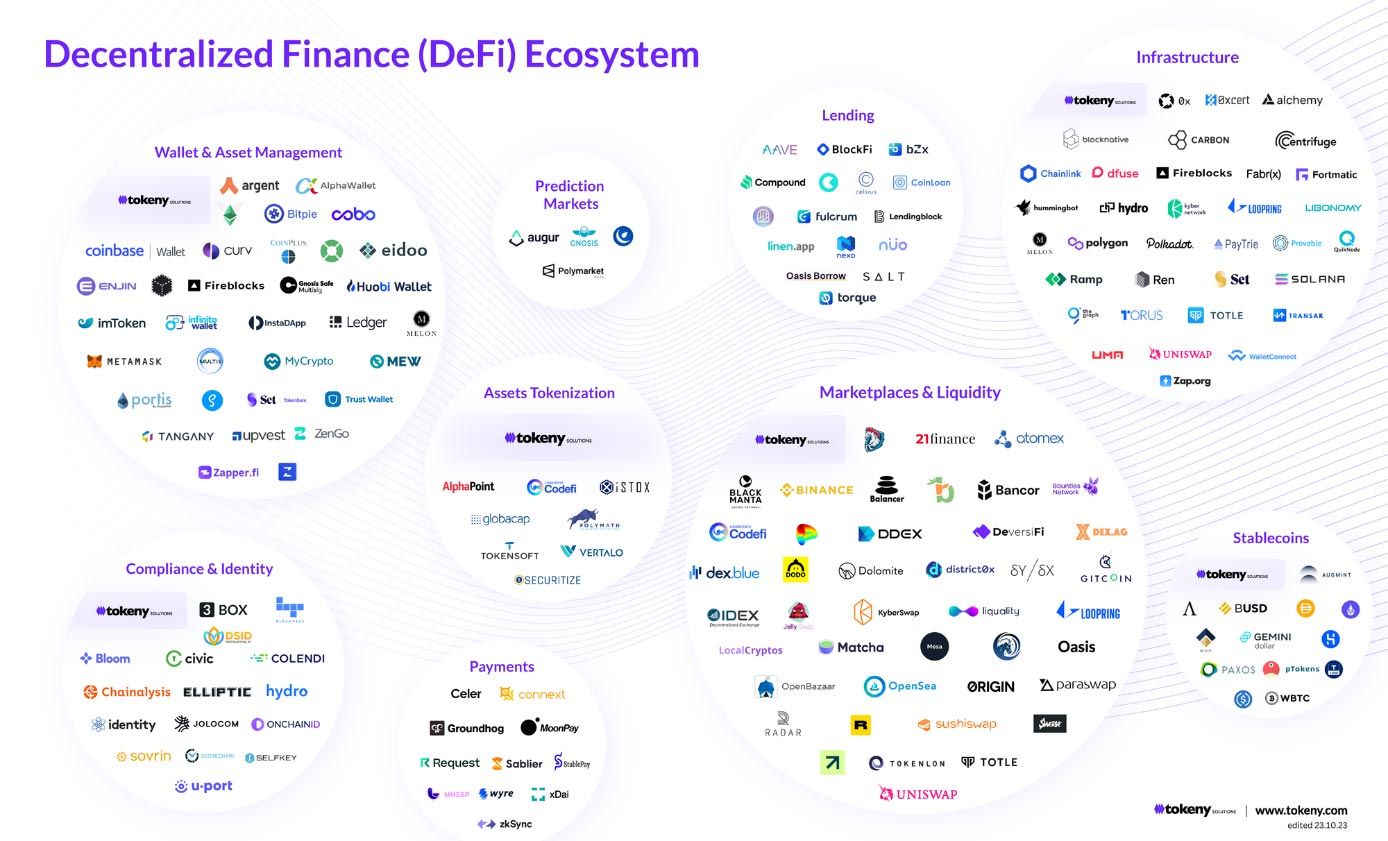

Simon: Basically, we are already in a market phase where I can say with certainty which areas have already been well adopted. Primarily, it’s exactly the services that your bank would otherwise provide for you. Here we’re talking about lending, currency exchange, financial transactions, trading, portfolio management, and even insurance. Another emerging area is prediction markets. In the attached graphic, we can see a good overview of all the players currently moving in the DeFi environment. New ones are added daily.

Philipp: What are the main risks and issues emerging in the DeFi sector, and how are market participants dealing with them?

Simon: The first thing that probably comes to mind is money laundering and other criminal activities. It’s worth mentioning that all these activities are just as, if not more, feasible in the traditional financial system. Fiat currencies are still the preferred choice for criminals in money laundering since they are used 800 times more frequently than cryptocurrencies (source). Everything on blockchains can be traced – this level of transparency doesn’t make it easy for criminals. As of today, there are sufficient companies that specialize in exposing suspicious activities.

Another elephant in the room when it comes to problems with DeFi apps: hacks and exploits. By mid-2023, there have been 148 individual hacks recorded, responsible for a loss of about $4.28 billion (source). That’s an issue. Blockchain Security & Audit is a relevant topic, and all well-known protocols and apps in DeFi have been audited by several auditors. Nevertheless, security must continue to be worked on.

Philipp: Can you describe an example of a DeFi project that you find exciting?

Simon: There’s quite a bit. Exciting is a good word for DeFi. Of course, there are the top protocols like AAVE, Maker, or Compound in decentralized lending, or Uniswap for currency exchange. However, I find projects like Ajna Finance particularly thrilling. Unlike the aforementioned lending protocols, Ajna does not rely on external data (so-called Oracles) that send off-chain data, such as current currency rates in real-time into the app’s smart contracts. This independence from Oracles also makes Ajna safer, as Oracles often represent a central dependency for the functionality of such apps. Ultimately, Ajna is also set up as I mentioned in one of my first responses: the project team has detached from Ajna, and the protocol now runs simply – without the need for further governance. Pretty cool.

The conversation with Simon has shed bright light on the exciting and rapidly developing field of Decentralized Finance (DeFi). By eliminating intermediaries, DeFi offers a robust and transparent financial infrastructure based on the principle of “Verify – don’t trust”. Power is distributed evenly, and transactions are irreversibly stored on the blockchain. The right timing, combined with technological advancements, has favored the growth of DeFi, particularly in areas traditionally covered by banks, such as lending, currency exchange, and insurance.

In the second part of the interview, we will delve deeper into the idea of digitalsocial.id. Don’t miss it!

The interview was originally conducted in German and was subsequently machine-translated.

Contact the author

Philipp Misura

Mail: Philipp.Misura@horn-company.de