PLENO’s Path Forward: Innovating for a Greener Future

PLENO’s Path Forward: Innovating for a Greener Future

Part Two: Exploring Advanced Strategies and Visions in the Evolving World of Carbon Credits

Welcome back to the second part of our insightful interview with PLENO. In the first part, we delved into PLENO’s origins, their innovative approach to carbon credit validation, and the integration of AI and blockchain in their processes. Now, let’s continue our exploration into how PLENO differentiates itself in the digital MRV (measurement, reporting and verification) landscape, their goals, partnerships, and their vision for the future of carbon markets.

Philipp: You have explained about the issues with carbon credit, and how tech like blockchain and technology can help. Can you now explain the process to create carbon credits?

Nura: Absolutely. The creation of a carbon project begins with an assessment of its feasibility and potential. This first step often involves consultants who estimate the number of carbon credits the project might generate. The project is then registered with a registry like Verra or Gold Standard.

The next step is to develop a detailed project design. This design includes a thorough explanation of the project’s activities and a more precise calculation of the expected carbon credits, as well as the plan for monitoring the project’s progress.

After this, the project must be audited by a third party. This audit is to ensure that the project is following the correct methodology. If the project passes this audit and is validated, the registries will issue the carbon credits.

It’s important to note that this is a simplified version of the process. In reality, especially for nature-based projects like forestry or mangroves, the process is more complex and involves various assumptions and models.

Philipp: Can you give a real example of how PLENO help projects in this process?

Nura: We make the start of the carbon project process easy and reliable. First, a project team logs into our platform and uploads their project’s location map. Then, they answer some questions about their project, like its category and planned activities. We’re currently focused on blue carbon projects, which include mangroves, seagrass, and wetlands.

After we have this information, our platform quickly analyzes the project site. We do what we call a ‘Rapid Assessment.’ This means we estimate the expected carbon impact of the project in minutes, not weeks. If a project already has ground data, they can upload it to our platform. We’ll adjust our calculations to meet standard registry requirements.

The project team can then share this data with their chosen third-party verifier or use our network of decentralized validators. The final step is monitoring. Our dashboard provides near real-time updates on the project’s progress, like emissions removed, and monitors risks like fires or floods. All these steps – measuring, reporting, and verifying – are combined in our digital MRV solution, making it a one-stop shop for creating carbon credits.

Image 2: Example of our Rapid Assessment solution to assess carbon of a Mangrove project

Philipp: How is PLENO different from the other digital MRV solutions?

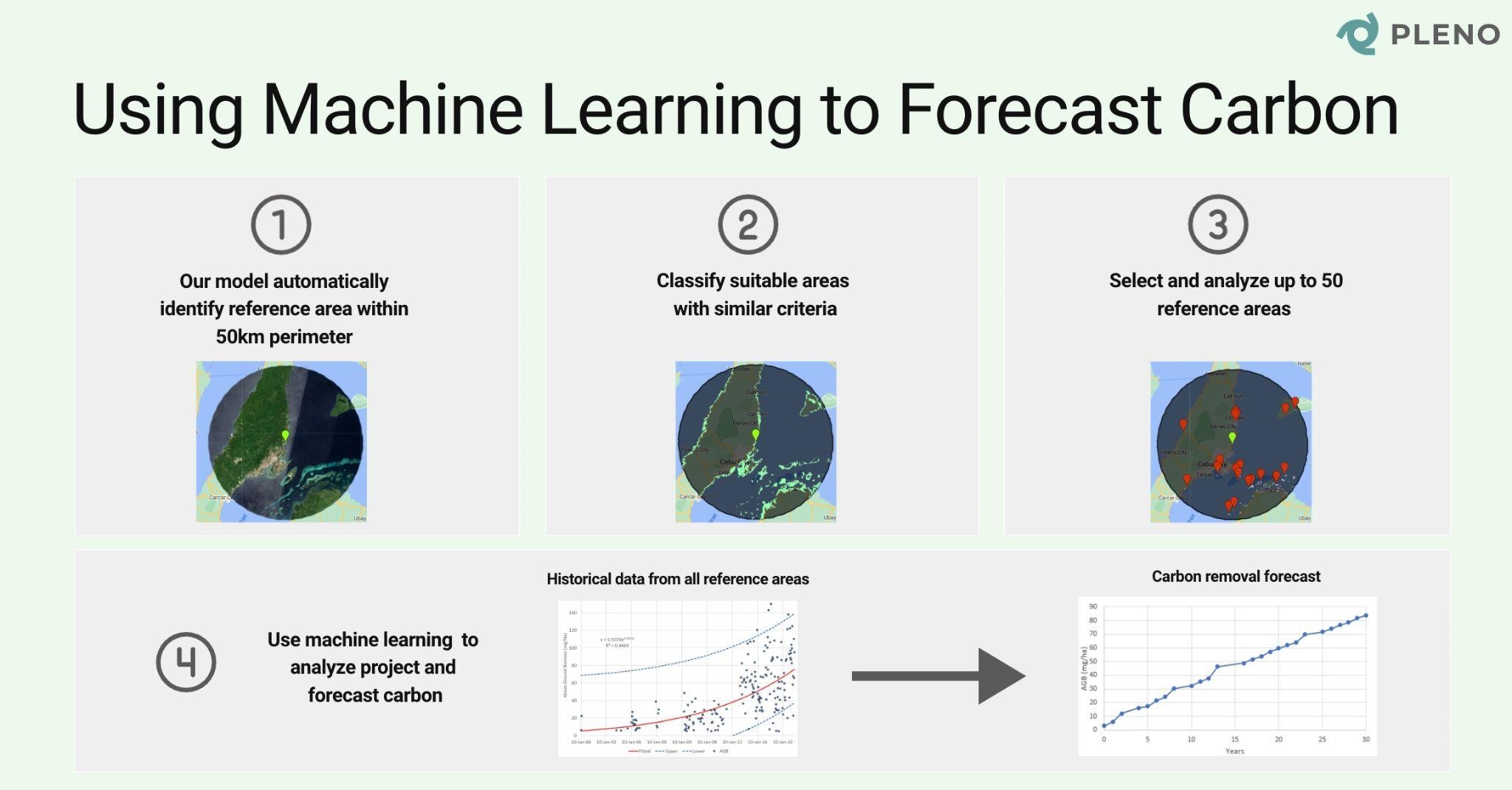

Nura: PLENO does more than just providing data and a monitoring dashboard. We focus on automation. Combining reliable data with AI to measure carbon accurately.

For instance, we’ve made a novel algorithm that can predict how much carbon an area will remove. It does this by looking at similar ecosystems nearby. For example, if we’re looking at a mangrove area, our system will automatically find other nearby mangroves and study their historical growth, like tree height and overall mass.

We’re also working on another model to identify different tree species automatically. This will help us guess how much carbon an area can absorb more precisely by knowing what kinds of trees are there.

This is just the beginning of our journey. The digital MRV field is brimming with innovative ideas from experts and major projects all over the world. At PLENO, we’re committed to developing a method that’s not only innovative but also repeatable. We want to pave the way for numerous projects to easily replicate our approach, thereby streamlining their processes and enhancing their ability to secure necessary funding.

Philipp: That sounds great. But why do carbon projects or buyers care to use your solution?

Nura: Right now, the carbon market is dealing with two big issues. First, creating carbon credits is a slow and complicated process. Second, buyers are losing trust, especially in nature based projects. Our solution tackles both problems. We give projects tools to make their work easier and more reliable. This also makes the calculations clearer and more trustworthy for buyers, derisking their investment.

Think of it like the finance market. We’re helping the people who analyze assets and also making those assets safer for investors.

What we’re doing benefits everyone – the people selling and buying credits, and the environment in general. By making the market work better, we attract more investment. This means more carbon is removed from the air, while the natural ecosystems are better protected.

Philipp: What are PLENO’s short-term and long-term goals, especially regarding the expansion of your digital MRV solutions?

Nura: In the long run, we want PLENO to be the engine in assessing various environmental data. We plan to offer various types of analyses on how different projects or activities affect the environment, making sure these analyses are both accurate and efficient. While we’re starting with carbon data, we have bigger plans. We see our digital monitoring and measuring tools being useful in many areas, like making supply chain impact more transparent.

Philipp: You are supported by the European Space Agency (ESA) business incubation program, how significant will their support be in accelerating PLENO’s development and product innovation?

Nura: We’re really excited to be part of ESA’s business incubation program. Thanks to this, we get funding, technical support, and connections with top aerospace companies in Europe, like Airbus, and leading research organizations. This support is a big deal for us. It means we can focus more on improving our satellite technology. One area we’re working on is monitoring underwater ecosystems for projects related to blue carbon – carbon captured by the world’s ocean and coastal ecosystems.

We’re also learning a lot from ESA’s own innovations, like how to assess vegetation health using data from satellites (a method called remote sensing). This knowledge is invaluable for us in making our products better and solving many issues in the carbon market.

Philipp: What are some of the biggest challenges and opportunities you foresee in scaling PLENO’s solutions?

Nura: Like many new startups, we face several challenges. One big challenge is making sure our carbon estimates are accurate. Although we followed international standards for this, like those set by the UN’s Intergovernmental Panel on Climate Change (IPCC), Verra, and others, there isn’t just one source of truth. Different standards and methodology use different ways and models to calculate carbon.

But starting a company means staying positive. We see these challenges as big opportunities. We can become the go to player that brings reliability and transparency in how the credits were calculated.

Philipp: How important is collaboration with other entities in the sustainability and tech sectors for PLENO’s growth?

Nura: For us, teaming up with others in the sustainability sectors is absolutely vital. The reason? The carbon market is not just growing; it’s evolving rapidly. As awareness among buyers increases, they’re starting to demand more transparency and openness in the market.

In this changing landscape, collaboration becomes more important. To drive positive changes, we engage with a diverse range of players. This includes the very projects that aim to reduce carbon, the auditing bodies that ensure these projects are on track, the registries that set the standards, and the buyers whose investments in carbon credits help fund climate projects.

By understanding and meeting the needs of these different groups, we can contribute more effectively to develop a solution that can catalyze more positive impact in removing carbon.

Philipp: What is your vision for the future of carbon markets, and how does PLENO fit into that picture?

Nura: In the next few years, the world needs to seriously work on reducing carbon emissions to reach the global net zero goals and tackle global warming. Think of it like a business ledger, where carbon now stands as a line item, reflecting its growing importance in financial decisions. This evolution is twofold: firstly, businesses are increasingly adopting voluntary carbon credits to offset their emissions. Secondly, regulatory frameworks, such as the EU’s Carbon Border Adjustment Mechanism, are beginning to link carbon emissions with economic consequences.

PLENO wants to be a catalyst in this evolving landscape. While our current focus is on carbon credits, our broader ambition is to revolutionize how environmental impacts are measured and validated. We’re not just content with the status quo; our aim is to transform the abstract notion of environmental benefit into tangible, quantifiable data. Imagine a world where every positive environmental action is not just a concept but a measurable, impactful reality. That’s the future that we are striving to create.

Philipp: To conclude, we would like to know how readers and the community can support PLENO. Are there any specific requests, offers of assistance, or messages you would like to convey to our readers?

Nura: First, a big thank you to everyone for reading and learning about carbon markets. It’s vital that more people become interested in this area. We need more awareness, capital, and innovation to tackle the carbon problem, one of our biggest environmental challenges.

Secondly, if you’re interested in being part of this change and want to know how we’re using advanced technologies for carbon credits, feel free to message me on LinkedIn. I’m always open to a zoom chat or coffee if you’re in Berlin.

Thanks for taking the time, Philipp.

We extend our heartfelt thanks to Nura and the PLENO team for their candid and insightful perspectives into the world of carbon credits and sustainability technologies. Their efforts to revolutionize the carbon market with innovative solutions are not only inspiring but also crucial in our collective fight against climate change. We look forward to following PLENO’s continued developments and successes and wish them all the best on their trailblazing journey towards a more sustainable future.

Contact the author

Philipp Misura

e-mail: Philipp.Misura@horn-company.de

Your gateway to industry knowledge and expert analysis! Follow us on LinkedIn for exclusive professional articles and project insights.