From the Wild West to a Regulated Future: MiCAR Revolutionizes the Crypto Industry!

#crypto #regulation #token

Common European Legal Framework for Crypto Assets

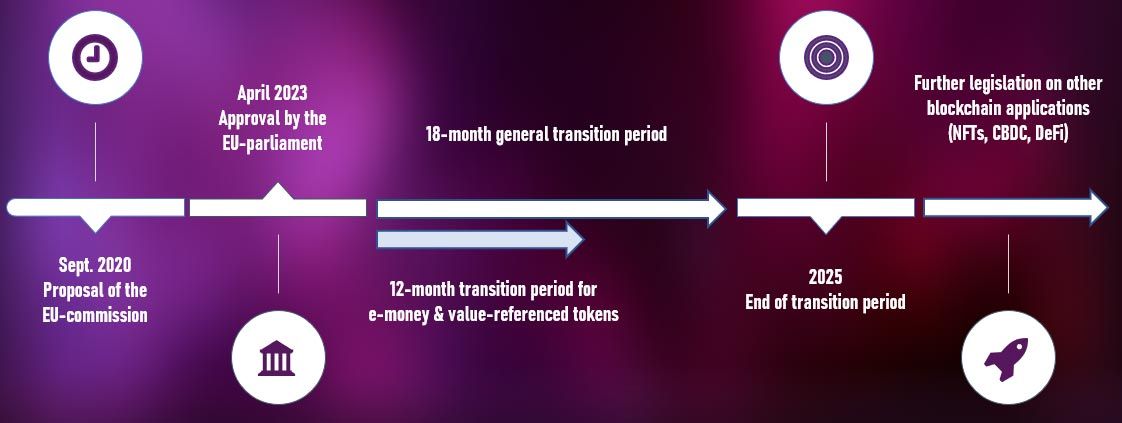

On June 29, 2023, the Markets in Crypto-Assets Regulation (MiCAR) officially came into effect. This marks the first unified legal framework for crypto assets within the EU. The new legislation aims to strengthen investor protection, market integrity, and financial stability. At the same time, it creates less fragmented regulation to foster trust in the technology, promote innovation, and eliminates regulatory distortions within the European Union.

With this new regulation, Europe takes a significant step towards legal certainty for the industry, setting itself apart from the rest of the world. The definitive departure from the regulatory „Wild West“ potentially creates a robust marketplace for developers and providers of crypto services, as well as institutional investors who are increasingly exploring the crypto market.

Application Scope of MiCAR

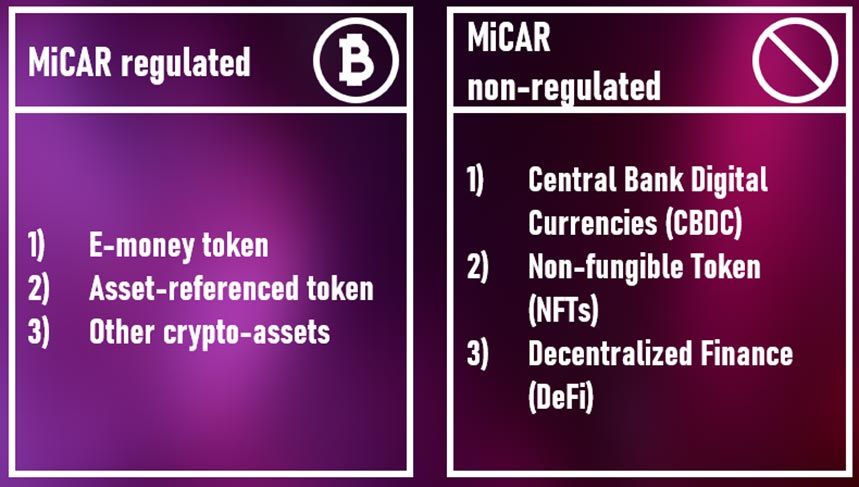

MiCAR’s scope is based on its newly created definition of crypto assets as “a digital representation of a value or of a right that is able to be transferred and stored electronically using distributed ledger technology or similar technology.” The regulatory changes are not the same for all crypto assets but differ based on how each asset is classified. In this regard, various types of crypto are distinguished. In particular, asset-referenced tokens and e-money tokens (stablecoins) that achieve value stability by referencing official currencies or other assets (e.g., Tether) are subject to stricter requirements than non-referenced tokens. For stablecoin issuances for example, a mandatory liquid reserve in a 1:1 ratio is required. Additionally, “utility tokens” intended solely to provide access to a good or service provided by the issuer are treated separately.

MiCAR is primarily focused on regulating private crypto service providers (both individuals and legal entities). It does not include regulations on central bank digital currencies, which the European Commission has recently addressed in a separate regulatory proposal. Similarly, applications related to decentralized finance (DeFi) and explicit regulations for non-fungible tokens (NFTs) are currently not covered. Furthermore, crypto assets falling under the regulatory framework of MiFID II are exempt from MiCAR’s scope. This includes electronic securities, which are additionally regulated in Germany through the new Electronic Securities Act (eWPG).

New Obligations for Crypto Issuers and Service Providers

The new harmonized framework includes various specific provisions for crypto assets, related services and activities that were not previously covered by existing EU legislation in the field of financial services.

Crypto asset issuers will be required to publish a “White Paper” in the future. Similar to prospectuses for other financial products, it must contain detailed information about the issuer and the token. These documents must be written in at least one official language of the home member state or in English. The aim is to inform especially retail investors about “the characteristics, features, and risks of the crypto assets they intend to purchase.”

Under MiCAR, trading in crypto assets will require authorization throughout the EU. This includes not only traditional trading platforms but also banks and securities firms that facilitate crypto trading. Service providers who already have authorization from the German BaFin (Federal Financial Supervisory Authority) are not exempt, as the MiCAR requirements go beyond existing German regulations. Additionally, the regulations against market abuse and insider trading with crypto assets will be tightened, and new obligations will be created to protect investors in crypto services, such as stricter segregation of customer assets from the service provider’s own assets.

Transition Period Ends in 18 Months

The regulations impose an obligation for the affected financial service providers to implement them within the next 18 months. Parts of the provisions regarding e-money tokens and stablecoins will even come into effect as early as June 30, 2024. Therefore, it is advisable for the respective institutions to proactively engage with the implementation of the new requirements or consider them if there are plans to include trading or custody of crypto assets in their service portfolio. The experts at Horn & Company, with their extensive experience in financial markets and projects related to regulation and the blockchain sector, are available as contact persons to assess and accompany the existing implementation possibilities.

Understanding the New Regulation as an Opportunity

Providers of crypto services or institutions planning to offer such products should not only perceive the new regulation as an additional bureaucratic burden but also as an opportunity. The newly created legal framework can prove to be a milestone in strengthening the trust of market participants in the still imperfect and volatile crypto market. Additionally, European regulation could evolve into a global standard, making the European location even more attractive. In recent years, various international organizations (including the IMF, OECD, and World Economic Forum) have made efforts to develop frameworks for a global approach. Financial service providers that comply with European requirements for crypto services are likely to be well-prepared for the global market in the future.

Contact the author

Martin Rupprecht

E-Mail: martin.rupprecht@horn-company.de

Contact the author

Philipp Misura

E-Mail: Philipp.Misura@horn-company.de