You Shall Not Pass (to another use case) – Non-fungible Token trapped in the art universe?

#DigitalAssets #NFT

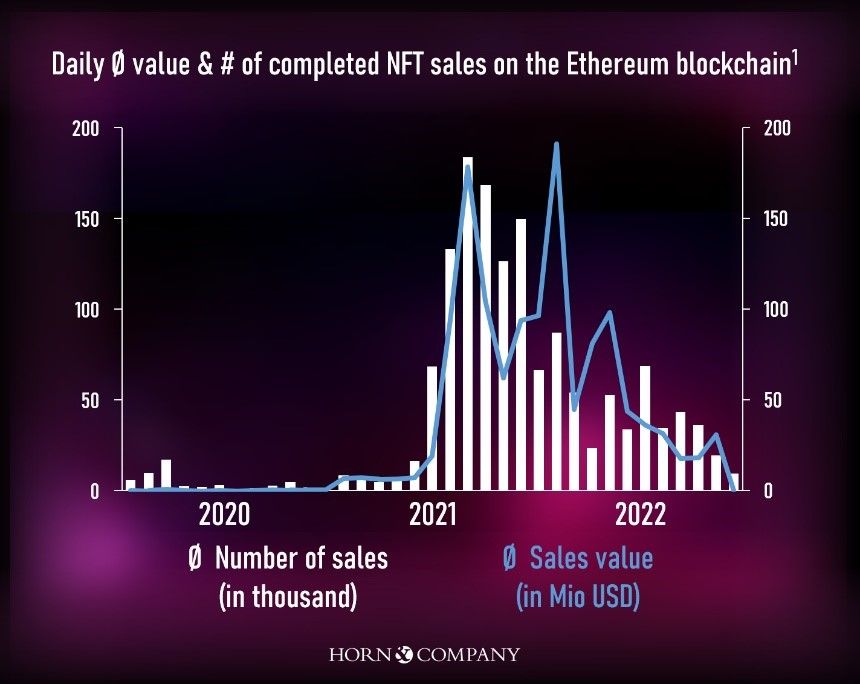

Non-fungible tokens (NFTs) attracted massive interest from investors, especially in 2021. However, the situation changed in the summer of 2022. Articles started to emerge on the internet declaring the end of the NFT hype – was it all just a bubble?!

But what exactly are NFTs? NFTs are digital tokens based on blockchain technology. Unlike cryptocurrencies like Bitcoin or Ethereum, which are interchangeable, NFTs are unique and non-interchangeable. They represent digital assets such as artwork, music, videos, or virtual properties. Each NFT contains metadata that includes information about the owner, creator, and characteristics of the asset.

NFTs gained significant media attention, especially with the rise of digital art. Notable examples include NFT collections like Bored Ape Yacht Club or CryptoPunks, for which collectors offered millions of dollars. However, beyond the widely discussed digital images, NFTs were rarely addressed. It seems that non-fungible tokens, despite their potential for other applications, are trapped in the art universe.

Example NFTs: Bored Ape Yacht Club Collection (Screenshot: www.boredapeyachtclub.com)

But what could be the use cases of crypto tokens beyond digital art? To answer this question, one must understand the idea behind NFTs. NFTs were created to address the authentication and traceability issues of physical and digital products. By using NFTs, the origin, ownership rights, and other relevant information of products can be transparently and securely recorded on the blockchain. This can curb product counterfeiting and promote the trade of high-quality and unique items. Thus, they represent one-of-a-kind assets that can depict not only digital artworks but also real-world objects on the blockchain. Therefore, NFTs can also be referred to as digital authenticity certificates.

Due to these characteristics, the potential range of applications for NFTs can extend to digital identities, tickets, or patents, for example. The latter offers an interesting use case. IP-based non-fungible tokens can address issues related to copyright. The IPwe platform, for instance, enables the digital representation, trading, and licensing of patents. This provides companies with the opportunity to use patents as digital assets for collateral or as a value store.

In mid-January 2023, IPwe announced the development of a dynamic NFT blockchain solution. The goal is to store all types of information related to each patent. Owners of intellectual property will have a clear representation of asset ownership through “IPwe Digital Assets.” A total of 25 million patent NFTs will be generated or minted.

The significance of this solution should not be underestimated. It addresses the challenges that companies face when considering the management of IP assets. Intellectual assets typically constitute a significant part of a company’s balance sheet. With the help of IPwe Digital Assets, companies can evaluate and manage their existing IP portfolios as liquid financial investments.

Therefore, it is a mistake to associate NFTs exclusively with digital images. The use cases are much more diverse and powerful. Especially with the rise of the metaverse, such solutions are becoming increasingly important. We are confident that NFTs will rise from the shadow of Bored Apes and CryptoPunks. The only question is how quickly this will happen…

[1]: https://www.statista.com/statistics/1265353/nft-sales-value/

Kontakt zum Autor

Martin Rupprecht

E-Mail: Martin.Rupprecht@horn-company.de

Kontakt zum Autor

Philipp Misura

E-Mail: Philipp.Misura@horn-company.de