Three crypto takeaways from 2023: Bitcoin’s recovery, Solana’s impressive performance and Tether’s dominance in the stablecoin market

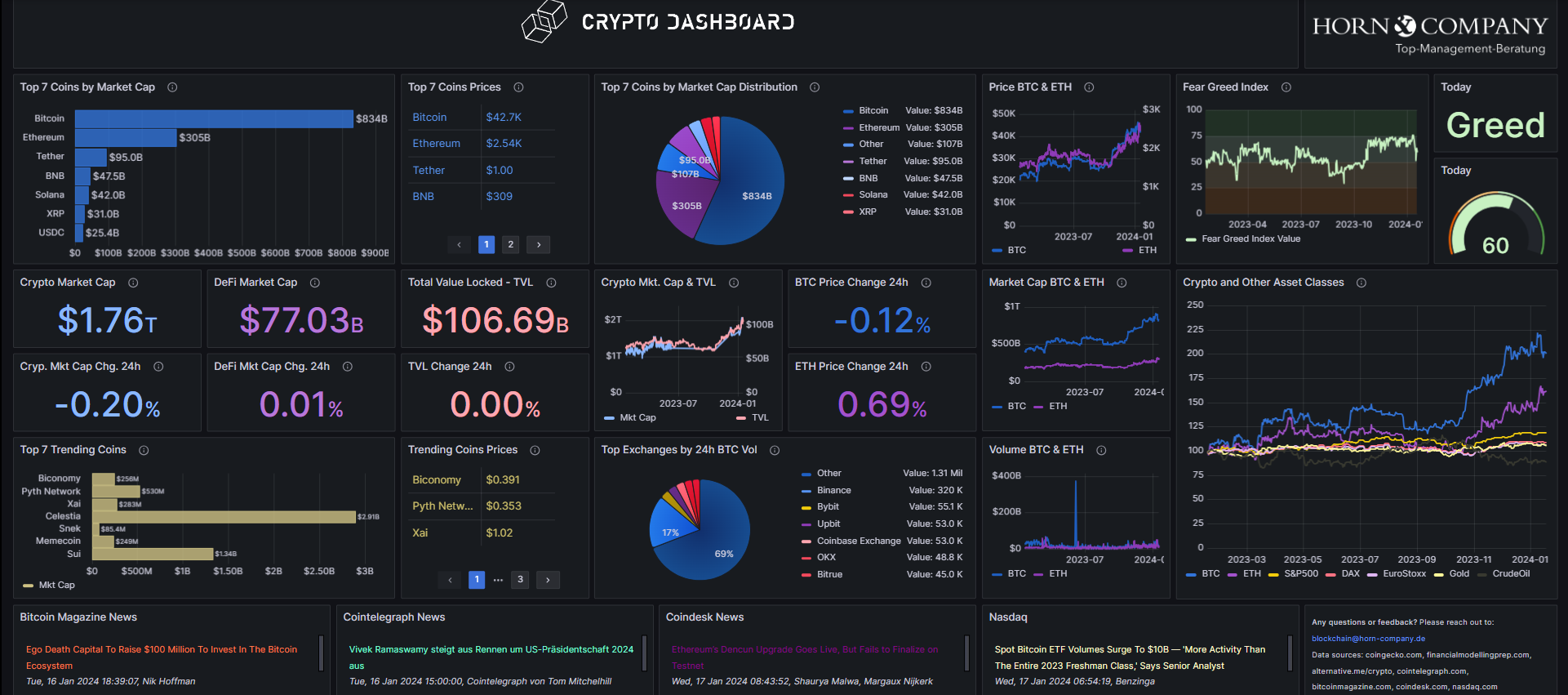

2023 was another exciting year for the development of blockchain technology in general and the acceptance of cryptocurrencies in particular. Our Horn & Company Crypto Dashboard allows you to keep track of the latest developments and news around cryptocurrencies and technologies in 2024. Freely available:

In this article, we summarize three key findings from 2023, offer insights into what we can expect for 2024, and why 2024 will be even more exciting.

Summary: In this blog post, we have focused on Bitcoin, Solana and Tether and explain why we think their development is particularly interesting: Bitcoins price rose from just over USD 16,000 to almost USD 45,000 in 2023, driven by factors such as the collapse of the SVB, regulatory challenges and the announcement of BlackRock’s Bitcoin ETF filing. Solana’s market capitalization rose to USD 45 billion in 2023 and experienced a price increase of almost 700%, thanks to technological advances such as State Compression and Firedancer, as well as strategic partnerships with Visa and Shopify. Tethers USDT maintained a dominant position in the shrinking stablecoin market, achieving nearly 70% market share due to its stable US dollar peg and increasing transparency.

1. renewed interest in Bitcoin

Overview of Bitcoin’s development

In 2023, Bitcoin received significant institutional attention, which strengthened its dominance in the cryptocurrency market. This renewed interest was reflected in its market capitalization and trading volumes. Despite challenging economic conditions, Bitcoin experienced significant growth. Bitcoin started the year at just over USD 16,000 and reached a 12-month high of almost USD 45,000 at the beginning of 2024. This impressive rise equated to an annual gain of over 160% and shows the resilience of Bitcoin, even in difficult global economic conditions.

Decisive events for Bitcoin in 2023

There are many factors that have contributed to Bitcoin’s recovery in 2023. In this blog post, we would like to focus on three events that we believe are of particular importance:

The Silicon Valley Bank (SVB) collapse: The SVB collapse in March 2023, which shook the traditional banking sector, inadvertently highlighted the benefits of Bitcoin’s decentralized nature. This event sparked significant interest in Bitcoin, driving its price to over USD 30,000 in April after trading at USD 20,000 shortly before the collapse.

Regulatory challenges: In June 2023, lawsuits against Binance and Coinbase by the SEC led to temporary dips in the Bitcoin price, reflecting the impact of regulatory action on the crypto market. These events led to a temporary dip in the Bitcoin price, but also showed its resilience as it quickly recovered despite the regulatory challenges faced by two of the largest crypto exchanges.

BlackRock’s Bitcoin ETF: Another relevant factor in June 2023 was the announcement of BlackRock’s filing for a spot Bitcoin ETF. In October, the appearance of BlackRock’s proposed Bitcoin ETF ticker on the DTCC website meant a further boost to the price of Bitcoin. Although no immediate approval was signaled, the release of the ticker was positively received by the crypto market: The announcement led to a rapid market movement, with the price of Bitcoin rising remarkably to around USD 35,000.

Bitcoin in 2024: what will be important

Of course, we will not attempt to predict Bitcoin’s path in 2024 given the many factors that can influence its price. However, besides economic conditions – Bitcoin tends to perform well in a lower interest rate environment – or regulatory decisions, there are two events that will play a major role in Bitcoin’s development. The first major event was undoubtedly the SEC’s decision to approve the BlackRock Bitcoin Spot ETF on January 10. The implications of this decision will be huge: Not only will this allow institutional clients to invest in Bitcoin through conventional investment products, but Bitcoin will once again pave the way for other cryptocurrencies and their entry into the institutional and less tech-savvy client space. Specifically, this development is illustrated by the hope for the approval of ETH Spot ETFs, for which prominent companies such as VanEck, Fidelity and BlackRock have submitted applications. Secondly, the expected Bitcoin halving event in 2024 will reduce the reward for mining new blocks. Bitcoin halvings occur approximately every four years and are part of Bitcoin’s design to control its supply. In the past, halving events have been characterized by a similar price development pattern, leading to another price high in the year following the halving.

2 Solana’s impressive development

Overview of Solana’s development

Solana’s performance in 2023 has been characterized by a significant price increase of over 700% in the last year, resulting in Solana’s market capitalization now being the fourth largest, reaching almost USD 45 billion. This rally has been driven not only by market sentiment, but also by tangible improvements and developments in the Solana ecosystem that have made Solana arguably the most popular layer 1 alternative to Ethereum. In the following section, we would like to highlight some of the most relevant developments for Solana.

Key drivers behind Solana’s growth

State Compression: A technological advancement based primarily on Merkle trees that allows multiple changes to be made to a tree while maintaining the integrity and validity of the tree. This has significantly reduced the costs associated with on-chain activities and has particularly benefited the NFT sector by enabling the creation of a single NFT for less than a penny (on the Ethereum blockchain, the creation of an NFT costs more than USD 2 in most cases).

Localized Fee Markets: The unique ability of Solana’s Virtual Machine to process transactions in parallel, increasing efficiency. Unlike systems where transaction fees are set uniformly across the network, Solana’s Localized Fee Market allows transactions to be processed in parallel, making Solana cost-effective for users and attractive for a range of decentralized applications (dApps).

Firedancer Looking ahead, the Firedancer upgrade is expected to further enhance Solana’s transaction processing capabilities and mark a significant leap in its technological development. One of the most notable aspects of Firedancer is its potential to increase Solana’s transaction processing capacity to up to 1 million transactions per second. This is a significant leap from current capacity and far exceeds the transaction capacity of many existing blockchains and traditional payment providers such as Visa, which process around 65,000 transactions per second.

Strategic Partnerships: Solana’s diversification into various consumer-facing categories, including partnerships with large enterprises, signaled its growing influence beyond traditional DeFi applications. Two of Solana’s key partnerships are with Visa and Shopify. Both partnerships were initiated primarily due to Solana’s high transaction throughput and cost efficiency. Shopify implemented Solana Pay to enable users to pay with the USDC stablecoin. The final fees are said to be lower than those that would be incurred for a standard credit card payment. Visa is exploring stablecoin processing with Solana and is particularly reliant on the high throughput of the network.

3 Tether’s dominance in the stablecoin market

The development of the stablecoin market

At the beginning of January 2024, the total market capitalization of stablecoins is USD 130 billion, reflecting a 22% decrease from USD 167 billion in the previous year. With different developments of the largest stablecoins, USDT, BUSD, USDC, USDP and DAI showed different degrees of stability and market changes throughout the year. In this sense, the evolution of Tether’s USDT to dominate the stablecoin market was exceptional.

Tether’s development and market position

In 2023, when the market capitalization of most stablecoins declined, the market capitalization of Tether’s USDT remained stable (at around USD 90 billion) in an overall shrinking market. Tether now accounts for almost 70% of the total stablecoin market and underlined its dominant position, which is also supported by a trading volume that is nine times higher than that of Circle’s USDC, the second largest stablecoin by market capitalization. This tremendous development consequently boosted profits for Tether Holdings, the company behind USDT, which reported over USD 1 billion in operating profit for the second quarter of 2023.

Tether’s success and outlook for 2024

Tether’s (USDT) dominance in the stablecoin market is largely due to its constant peg to the US dollar, even under pressure, unlike USD Coin (USDC), which failed to maintain its dollar peg in March with the collapse of the SVB, leading to a loss of confidence among users. In addition, Tether has increased its transparency by publishing data on financial stability and excess reserves. Another important factor for the different development of the two stablecoins is the different use cases: USDC is mainly used by US-based firms to maintain on-chain liquidity, while USDT finds wider use among retail users in emerging markets. This situation reinforces Tether’s near absolute dominance in the stablecoin market. Even new players such as PayPal’s PYUSD stablecoin have struggled to make a significant impact.

For the coming years, analysts forecast a significant increase in global stablecoin transactions, which could potentially exceed 187 billion transactions by 2028, from around 53 billion in 2023. The main area of application for stablecoins remains cross-border payments with their advantages in execution time for cross-border processes, improved transaction traceability and simplified settlements. The further development of stablecoins will be particularly interesting with regard to potential competition from central bank digital currencies (CBDCs). However, their early development phase and the expansive cross-border market indicate strong growth potential for stablecoins alongside CBDCs.

The Horn & Company Crypto Dashboard allows you to stay informed about the latest news and trends in cryptocurrencies and technology at all times

The year 2023 was characterized by remarkable growth and resilience for cryptocurrencies, especially for Bitcoin and Solana. Both cryptocurrencies overcame unique challenges and used their strengths to improve their market position. Looking ahead to the coming year, we expect that Bitcoin, Solana and the stablecoin Tether will not be the only ones shaping the future of the financial industry. With the potential growing importance of cryptocurrencies to the financial services industry as a whole, it is imperative to stay informed and adaptable – in a dynamic and rapidly changing environment. Our Horn & Company Crypto Dashboard is designed to do just that, ensuring you’re always just a click away from the latest updates in 2024.

Contact the author

Hans Christian Schmitz

e-mail: hans-christian.schmitz@horny-company.de

Contact the author

Martin Rupprecht

e-mail: martin.rupprecht@horny-company.de

Your gateway to industry knowledge and expert analysis! Follow us on LinkedIn for exclusive expert articles and insights.