Digital euro offers numerous advantages

#crypto #cbdc

In the German financial industry the introduction of a digital euro has been discussed for some time. The European Central Bank (ECB) has announced its intention to introduce a digital euro as a supplement for cash, referred to as a retail CBDC (Central Bank Digital Currency). There is also a discussion of offering the digital euro in a more advanced tokenized version, referred to as a wholesale CBDC, which would provide the opportunity to improve background processing (clearing and settlement) between banks through the use of smart contracts. The first draft of the digital euro is expected to be presented to the Council of the ECB in the fall of this year.[1]

According to Bundesbank board member Burkhard Balz, initial pilot testing with the digital euro could begin in the fall of 2023.[2] As state-guaranteed central bank money, monitored by the ECB, the digital euro offers decisive advantages in terms of usability over other digital currencies such as Bitcoin or Ethereum, which are very opaque and difficult to control due to their decentralized structures.

Why is there a need for the digital euro in the first place?

The digital euro (retail CBDC) is primarily being introduced as a complementary payment method to cash in order to strengthen the digital payment capability within the European Union (EU) and to offer users more options for daily transactions. With the digital euro, the dependence on foreign private companies (such as Apple, Alipay, Google, PayPal, etc.) for digital payment infrastructure can be reduced. Consequently, financial inclusion can also be ensured by providing users with reliable and secure access to digital payment services, regardless of private service providers. The digital euro thus strengthens payment infrastructure and provides new opportunities for financial innovation.

How could the issuance of the digital euro be structured for users?

How exactly the digital euro (retail CBDC) will work and whether it will be based on blockchain or distributed ledger technology similar to cryptocurrencies is still under discussion. However, three different distribution channels are generally conceivable:

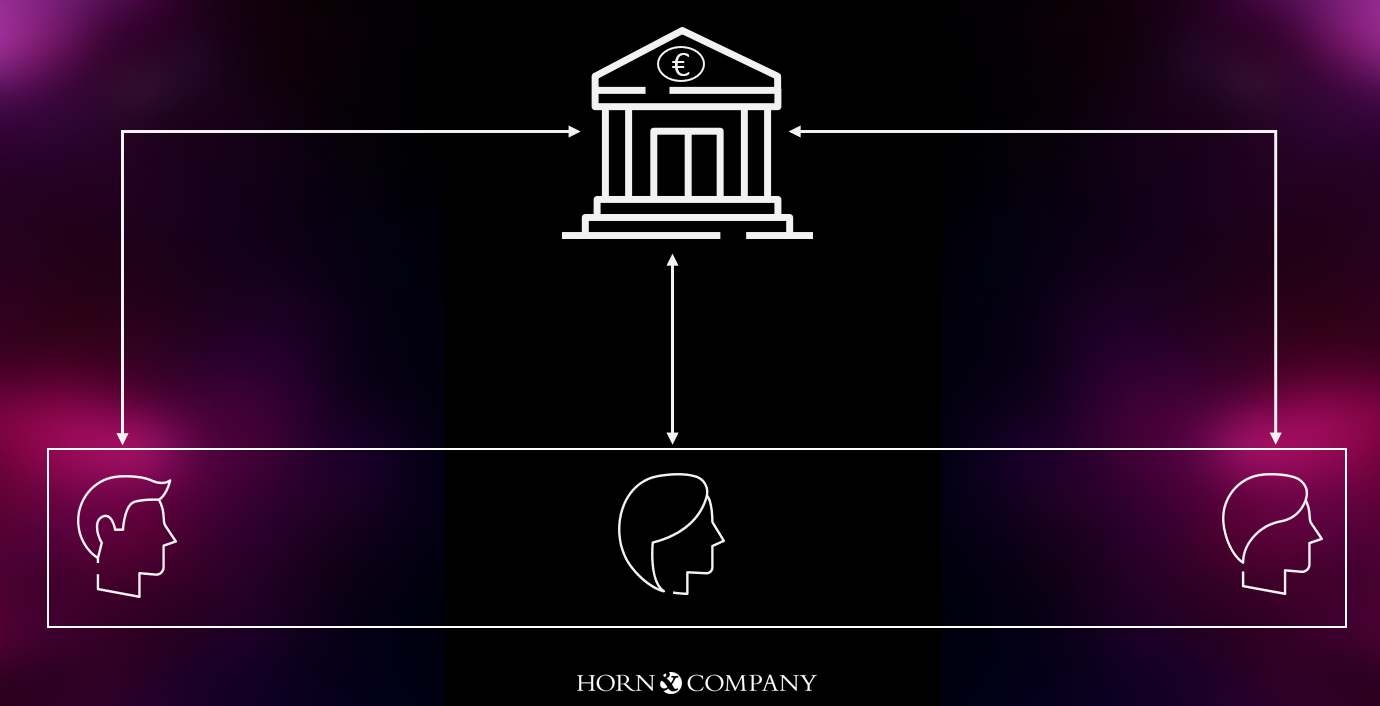

1. Unilateral digital euro [3]:

The possible introduction of a digital euro in “unilateral form” would be the most direct distribution channel. Specifically, the ECB would directly issue the digital euro to the end consumer and assume all the functions of banks in the supply of cash (such as providing euros and deposit storage). From the perspective of the National Association of German Cooperative Banks (BVR), this scenario would have immediate negative consequences for the liquidity situation of the banks – for example, if consumers withdraw their deposits and convert them into digital euros at the ECB, banks would have to obtain liquidity from the market in other ways (for instance by offering higher deposit interest rates, restricting lending, or issuing bonds).[4]

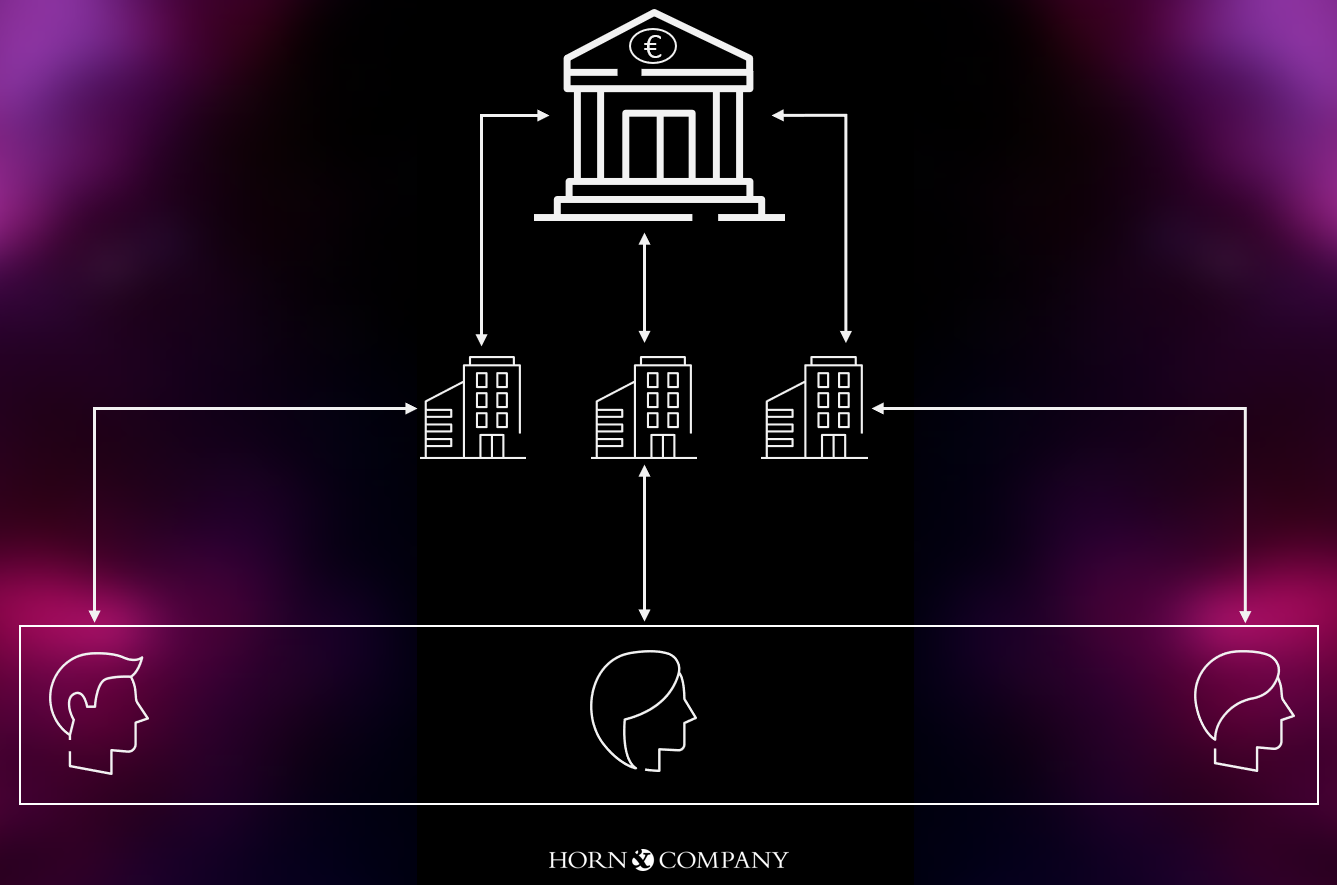

2. Mediated digital euro:

Another possible distribution channel would be an intermediary one, where the ECB appoints a bank or a fintech company to issue digital euros to end users. The intermediary would manage the digital euro wallets for customers and process payments between participating institutions or consumers. In this scenario, banks could continue to act as intermediaries between the central bank and their customers, maintaining their relationship with consumers. Banks could also use this distribution channel to offer additional services, such as wallet management or settlement processes. In general, the participating institutions would ensure the reliability and security of the transaction as the link between the ECB and end consumers. One potential risk would be excessive fragmentation of payment transactions, resulting in lower revenues for the intermediary and relatively high investment costs for providing the digital infrastructure.

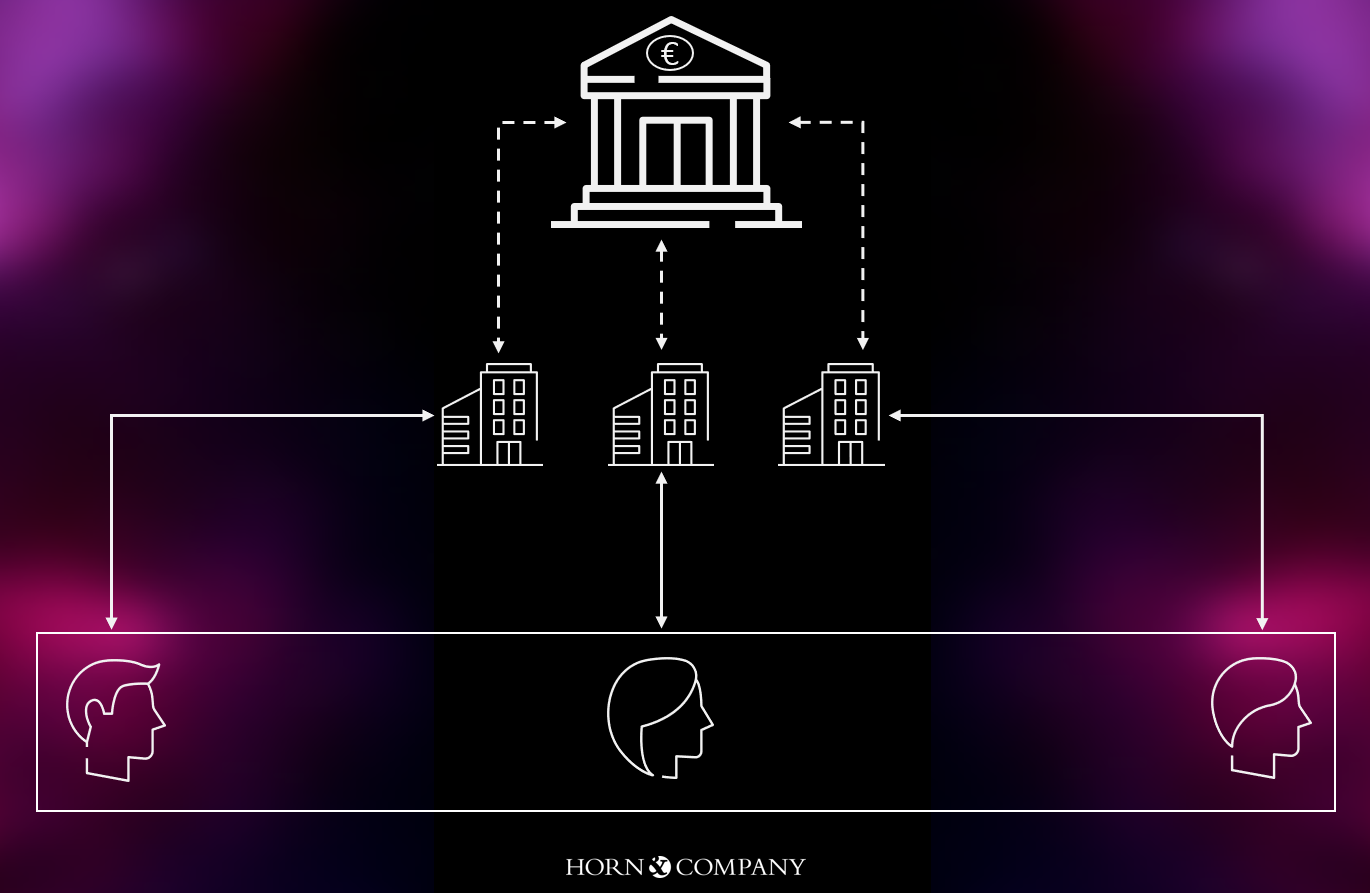

3. Synthetic digital euro

Another possible distribution method for a digital euro would be the synthetic digital euro. This is a digital currency that is issued by private financial institutions such as banks or financial service providers and serves as a digital representation of euro cash. These issuers work with the ECB and use their deposits at the central bank as a reserve for the issuance of digital euros. The advantage of this model is that banks can maintain their customer relationships and revenue sources by offering additional digital euro services without having to give up their existing role in the economy as the primary source of liquidity. Furthermore, the institutions would continue to have control over the internal customer history data.

Overall, the ECB has not publicly committed to a specific version of the digital euro so far and is currently examining various other options. Therefore, it remains to be seen which distribution channel will ultimately be utilized by the ECB and how the digital euro will be structured.

[1] https://www.ecb.europa.eu/…ecb.degov221221_Progress.en.pdf

[2] https://www.bundesbank.de/de/presse/reden/das-projekt-digitaler-euro–753288

[3] Abbildungen zu den jeweiligen Distributionskanälen in Anlehnung an:

https://www.imf.org/…Behind-the-Scenes-of-Central-Bank-Digital-Currency-512174

Contact the author

Christian Nostiz

E-Mail: christian.nostiz@horn-company.de

Contact the author

Philipp Misura

E-Mail: Philipp.Misura@horn-company.de