Harmful Digital Assets and Cryptocurrencies – Should We Be Concerned?

#digitalassets #crypto #esg

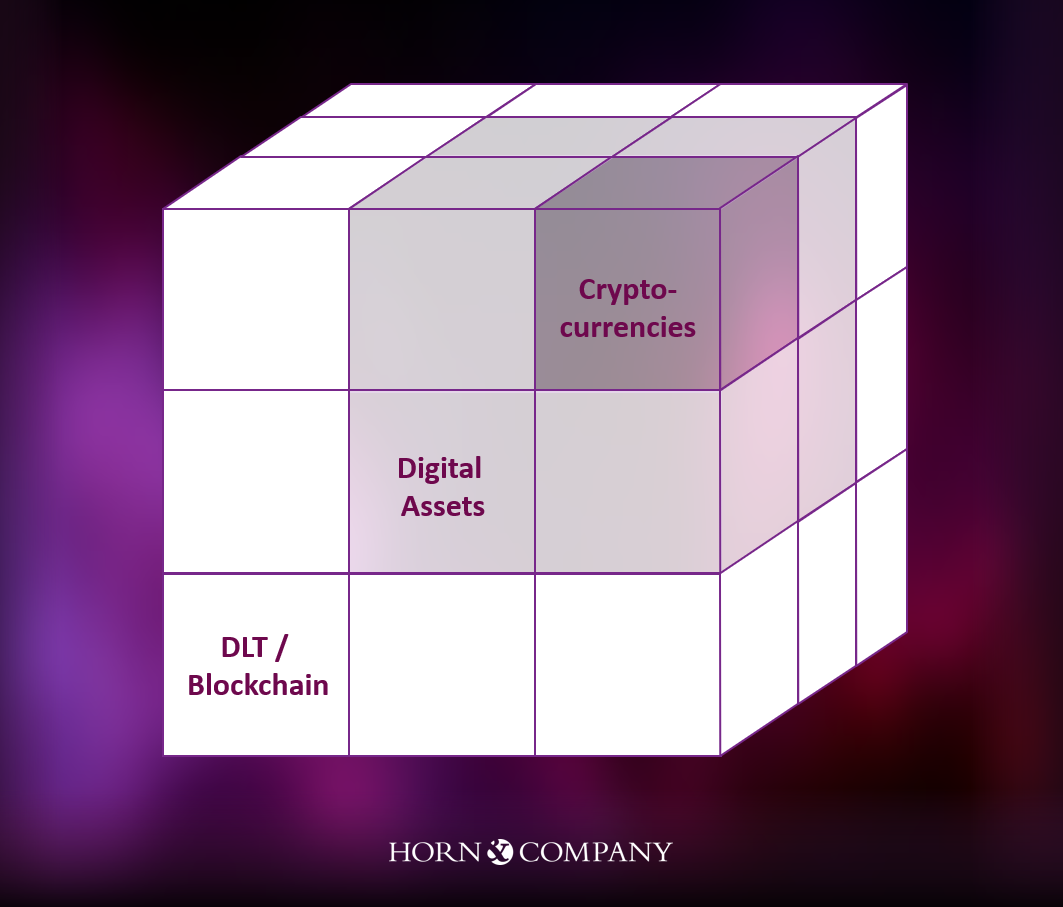

That question many in the financial industry are asking, especially when it comes to Bitcoin. Cryptocurrencies are often criticized for their enormous energy consumption. But before we delve into that, let’s take a look at the different types of digital assets.

Digital assets encompass a wide range of applications based on blockchain technology. This includes not only cryptocurrencies like Bitcoin, but also digital token, tokenized assets, digital identities, and insurance policies. Blockchain technology is characterized by decentralization, transparency, immutability, and security – all properties that are in high demand in today’s world.

Cryptocurrencies

Cryptocurrencies that use the “proof of work” consensus mechanism, by definition, have a high energy consumption. For example, Bitcoin, often referred to as “digital gold,” currently has an estimated annual energy consumption of about 128 TWh[1], which is comparable to the annual energy costs of gold mining. Compared to that, modern cryptocurrencies that use the “proof of stake” mechanism need significantly lower levels of energy. Ethereum, for example, has switched to “proof of stake” since 2022, saving about 99.9% of its energy consumption.

Apart from pure energy consumption, there are a variety of cryptocurrencies that have been explicitly developed for sustainable themes. They are designed to benefit solar power providers, build modern energy infrastructures, or provide computing power for global research. Not least, Bitcoin was invented with the idea of decentralization and the desire to provide a digital currency to theoretically every person – independent of banks or the financial system. This goal fits very well with the social idea of “banking the unbanked.”

Digital Assets

The multitude of possibilities of digital assets through blockchain technology enables a variety of applications and potentials for society as well as the financial industry. Through tokenization, theoretically all imaginable underlyings can become financial instruments that are infinitely divisible, tradable, and liquid. With a view to the global energy transition, this allows for a much broader financing and investor base for project financing in renewable energies. The resulting digitization and (partial) automation streamlines settlement processes and accelerates the transfer of finances and ownership titles. Overall, this makes the financial system more efficient, resource-saving, and potentially more transparent.

Blockchain Technology

Blockchain is a base technology whose potentials and possibilities are far from being exhausted today and are certainly not clearly recognizable in all areas. Given the great ESG challenges, however, there are potential applications ranging from efficient energy infrastructures to transparent and immutable supply chains for every end consumer. An exciting and highly topical example is the potential to transparently and almost in real-time efficiently map international CO2 emissions trading via a blockchain protocol to distribute emission credits more efficiently on the market. Although much of this is still wishful thinking, the developments of the coming years will undoubtedly produce exciting and, above all, useful applications with real added value.

Conclusion

Bitcoin has a high energy consumption, but this must always be considered in relation to its benefits and output. However, there are a variety of other cryptocurrencies with a positive impact. All in all, digital assets have enormous potential to transform the financial industry efficiently and thus ultimately provide greater value for the environment and society.

Contact the author

Philipp Misura

E-Mail: Philipp.Misura@horn-company.de

Contact the author

Martin Rupprecht

E-Mail: Martin.Rupprecht@horn-company.de