How to Buy an NFT

#DigitalAssets #NFT

Disclaimer: This article is for informational purposes only and does not constitute a recommendation to purchase non-fungible tokens or use the mentioned platforms.

Introduction

Non-fungible tokens (NFTs) are one of the many applications within the world of blockchain-based assets. Unlike traditional cryptocurrencies like Bitcoin or Ethereum, which can be exchanged interchangeably (fungible) to conduct transactions, NFTs are unique.

One use case for NFTs in the financial market is the tokenization of assets (see also H&C publication on Digital Assets or here). By using NFTs, assets such as real estate or company shares can be converted into digital tokens. These tokens can then be recorded and traded on a blockchain, leading to increased liquidity and efficiency in the market (see also H&C publication on custodian institutions/electronic securities).

However, NFTs continue to receive the most attention in the realm of digital art. NFTs are used there to represent a unique digital artwork that cannot be duplicated.

The following part of the article focuses on purchasing such digital art objects:

How to Buy an NFT

Step 1: Set Up a Wallet

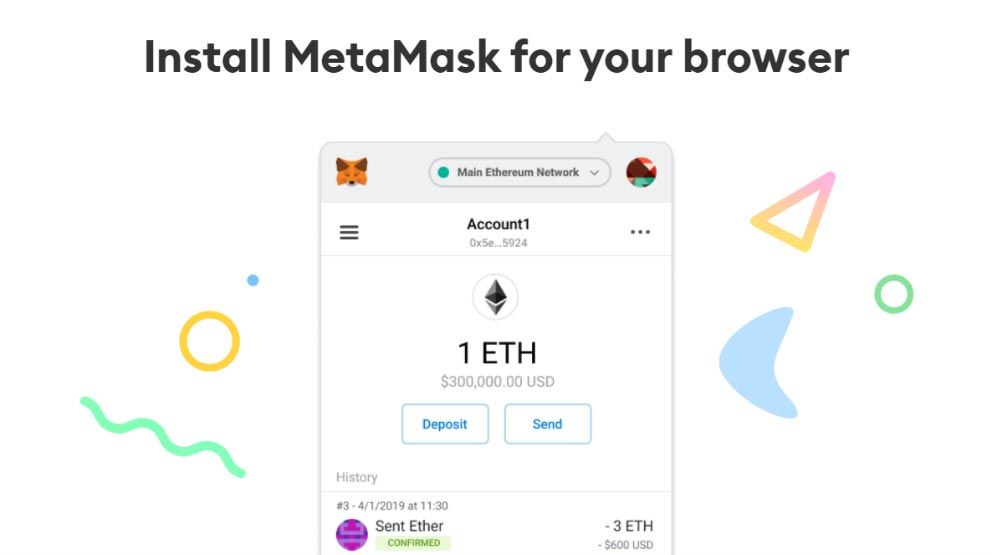

Before you can buy an NFT, you need a wallet (digital wallet) to store cryptocurrencies and the NFTs you purchase with them. There are various options, including online wallets like MetaMask and hardware wallets like Ledger. Make sure to protect your wallet carefully, as NFTs and cryptocurrencies are irretrievably lost if stolen from your wallet or if you lose your access credentials.

Example image 1: Online-Wallet-Provider „MetaMask“

Step 2: Buying Cryptocurrencies

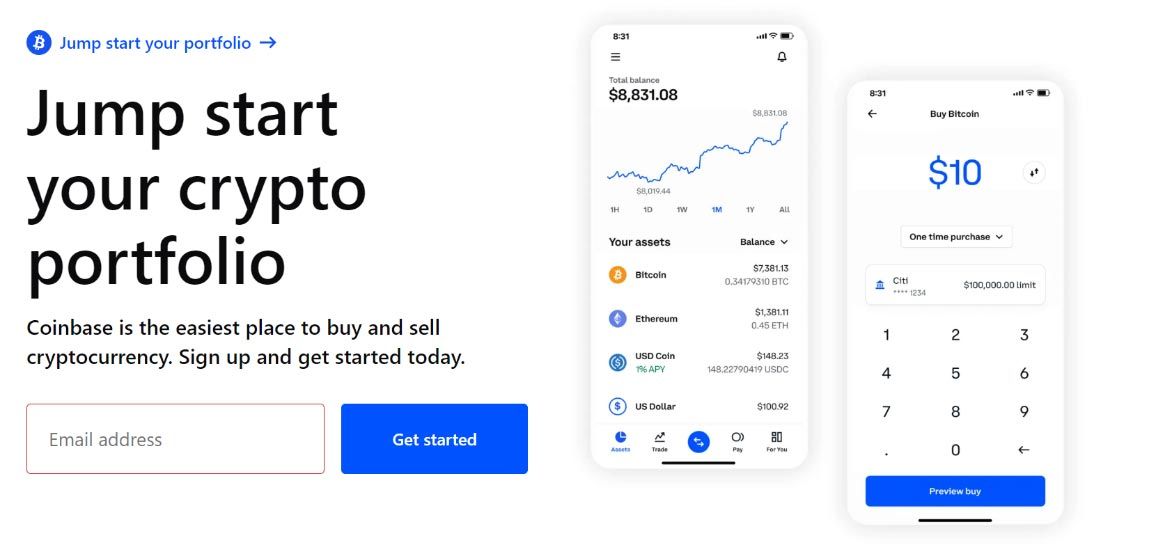

Once you have set up a wallet, you will need a trading platform to purchase cryptocurrencies with fiat currencies (e.g., Euro) and transfer them to your wallet.

Example image 2: Crypto Exchange „Coinbase“

Step 3: Selecting an NFT Marketplace

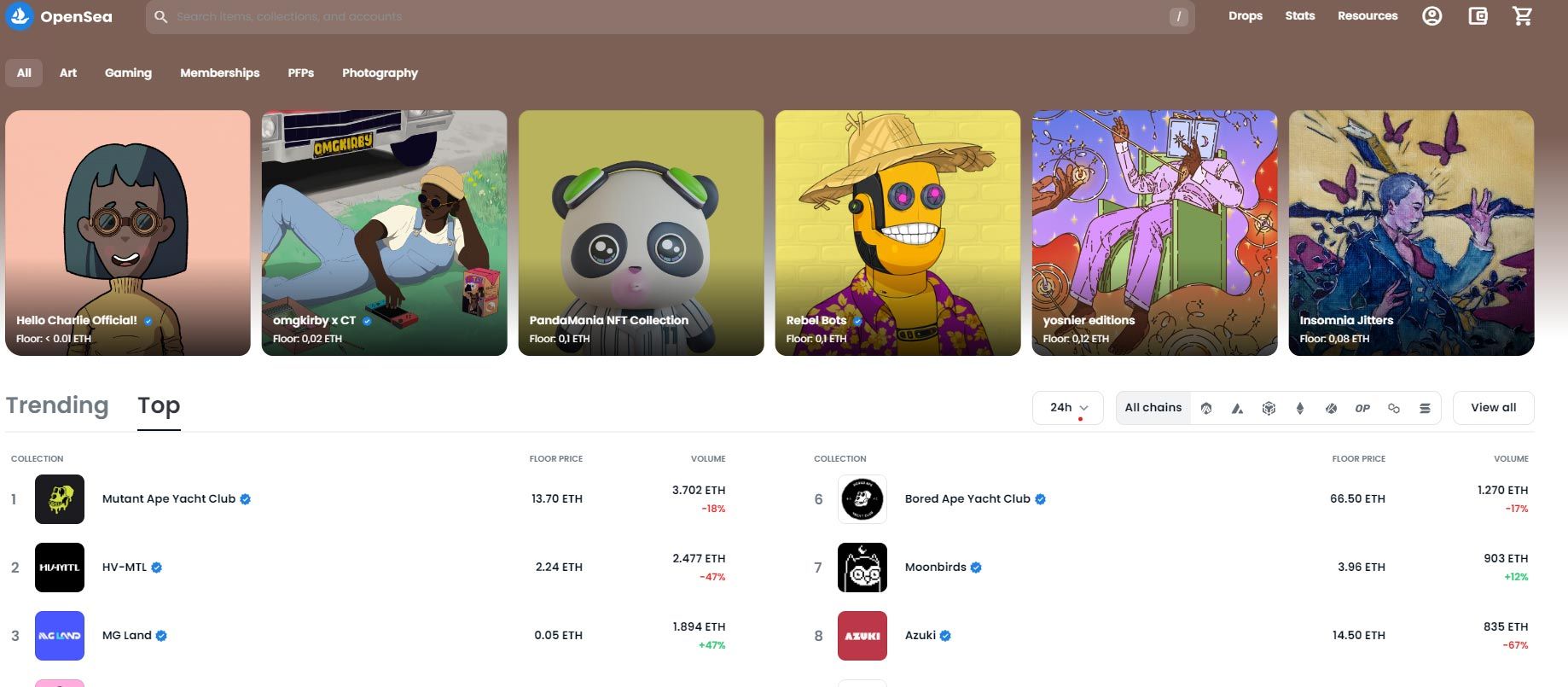

To purchase an NFT, you first need a marketplace where you can exchange cryptocurrencies for NFTs. There are various options, such as OpenSea, Nifty Gateway, SuperRare, or Rarible. You will need to sign up with the exchange of your choice and deposit your cryptocurrency into an account there or link your wallet with the NFT marketplace before you can make purchases.

Example image 3: The current largest NFT marketplace “OpenSea”

Step 4: Find the Desired NFT

Once you have transferred your cryptocurrencies to the NFT marketplace, you can search for the desired token. You can search based on specific digital artists or collections or explore more broadly based on the type of NFTs, such as collectibles or virtual properties.

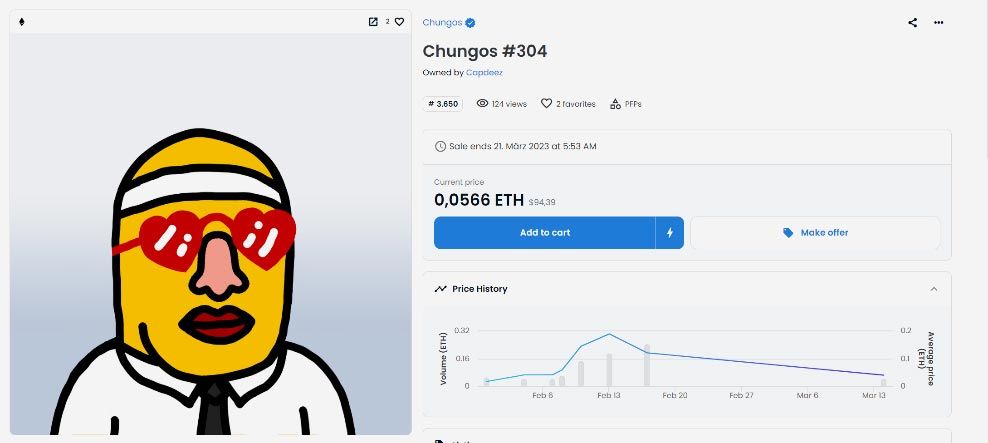

Each NFT has its own unique attributes that you should carefully examine before making a purchase. These attributes can include the edition of the NFT, the date of creation or sale, the creator, or the price.

Example image 4: Examples of an NFT profile picture collection

Step 5: Place Bids, Buy, Sell

Once you have found the desired NFT and are satisfied with its attributes, you can either place a bid or buy it immediately. If you place a bid, you will have to wait for the creator of the NFT to accept or reject your offer. If you choose to buy it immediately, the NFT will be added directly to your account.

Beispielbild 5: Angebots/Kaufseite auf einer NFT-Plattform

After purchasing the NFT, you need to store it in a digital wallet, or it will be automatically stored there by the exchange. You can keep it stored there, send it to others, or attempt to resell it through one of the NFT marketplaces.

Example image 6: NFT that the author bought for research purpose of this blog article (value decrease since January 2023 ~95%)

Conclusion and Implications for the Financial Market

Currently, NFTs offer speculative opportunities in the realm of digital art, primarily for risk-seeking investors. However, if the expectations of increased liquidity and facilitated trading through digitized assets materialize, NFTs could bring about profound changes in asset investment and management. Small investors, for example, could invest in assets that are currently difficult to access. Furthermore, decentralized monetization of content becomes possible, offering potential new sources of income. Therefore, despite the current limited use cases in the financial market, it is worthwhile to engage with the topic early on and build knowledge in this area, both as an interested individual and as an institution.

Contact the author

Martin Rupprecht

E-Mail: Martin.Rupprecht@horn-company.de