Regenerative Finance – Blockchain as a Catalyst for a Sustainable Economy

#ClimateFinance #RegenerativeFinance #ImpactInvesting #Blockchain #CarbonAssets #Web3 #DigitalAssets

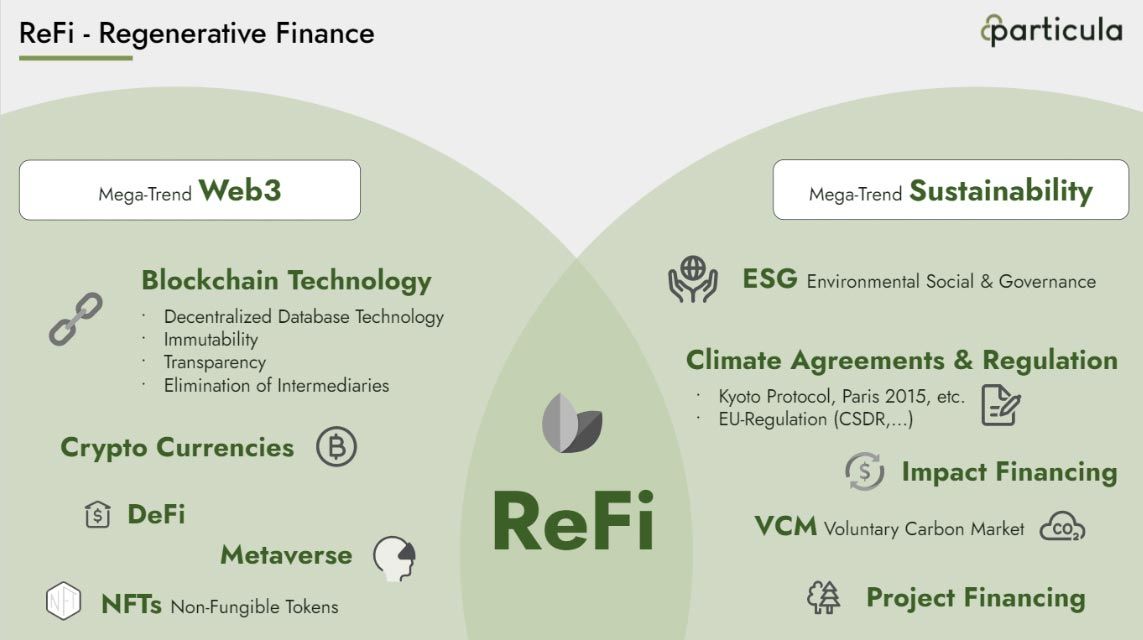

In the realm of ‘Climate Finance’, we’re currently witnessing a surge of innovative, green FinTech startups leveraging blockchain technology to make significant strides in climate protection. These ventures, centered around ‘Regenerative Finance’ (ReFi), are paving new pathways to channel capital into initiatives that foster sustainable and regenerative ecosystems. ReFi aligns closely with ‘Impact Investing’, an investment approach that seeks to bring about positive changes in Environment, Social, and Corporate Governance (ESG).

A forward-thinking financial system furnishes the necessary infrastructure and incentives for impact-focused investments. Within the context of ReFi and associated investments in environmental assets, previously illiquid asset classes are being tokenized using blockchain technology. This enhances tradability (via secondary markets) and transparency (through traceability), thereby preventing potential greenwashing and encouraging corporations to play an active role.

I had the opportunity to engage in a conversation with Nadine Wilke, the co-founder of Particula – a FinTech company based out of Munich. Our discussion revolved around the current trends in the ReFi market and the potential held by the emerging climate assets:

Philipp Misura: There’s already a large number of proponents claiming that ReFi, with all its possibilities, will change the world. Where does the term come from and what is the added value in ReFi?

Nadine Wilke: ReFi stands as the beacon of sustainability in the realm of Web3. It’s about exploring innovative pathways to restructure the capital market in such a way that it fosters a win-win situation for all parties involved. Too often, we witness a scenario where one party gains at the expense of another – sadly, it’s frequently the less developed countries, the environment, or the animal kingdom that bear the brunt. However, ReFi seeks to establish decentralized structures that cultivate all-encompassing value. The focus is on devising profitable incentives that aid people and nature in the long run and in a sustainable manner, as opposed to offering one-off or impulsive aid.

Philipp Misura: Could you provide a specific example? Is there a climate project that you find particularly fascinating and innovative?

Nadine Wilke: A project that particularly captivates me is Rebalance Earth, which is focused on protecting endangered forest elephants. Research has discovered that forests inhabited by these elephants sequester significantly more CO2 than those without them. Each elephant is monitored via cameras, sensors, and other specialized measuring devices, with the data processed through AI algorithms. This collected data allows for precise calculations of the amount of CO2 sequestered as these elephants contribute to the cleansing and fertilizing of the forest. These data are recorded onto a decentralized blockchain, and each elephant sighting generates a token or a tokenized CO2 certificate – automated through the use of so-called “smart contracts”. Seventy percent of the revenue generated from these tokens is allocated to the local community, safeguarding the elephants from poachers. Over its lifetime, an elephant can generate tokens valued at nearly 2 million euros. This ensures the forest remains healthy, the elephants are secure, and the local community is provided with resources to protect their environment and climate. This is a revolutionary form of financing, a system where AI, IoT, and blockchain symbiotically work together to create mutually beneficial situations.

Philipp Misura: The ReFi sector is still nascent, and it’s often criticized for its opacity. What do you believe is the reason for this?

Nadine Wilke: The data landscape for sustainable investments is still largely disorganized and the quality of data often leaves much to be desired. This is a challenge familiar to us from the traditional ESG space, where every larger corporation currently faces similar struggles. Within the ReFi ecosystem, while there are many providers of new financial instruments and several traditional infrastructure providers, no one yet exists who aggregates and standardizes data across this value chain. Each provider implements their own methods, formats, and data standards. This leads to a lack of comparability and necessary harmonization of data sets. With Particula, our aim is to foster greater transparency and drive mass adoption. This can only be achieved with a platform that aggregates, processes, and renders these new digital financial instruments transparent and understandable for institutional investors. A rating framework provides the essential structure and offers additional decision-making tools for sustainable investments and their impact. We’re currently in the process of building this data and rating platform.

Philipp Misura: How exactly can blockchain assist in creating greater transparency?

Nadine Wilke: Blockchain can facilitate the design of an interoperable system. Currently, there are various trading systems and markets for CO2 certificates, such as the Compliance Carbon Market and the Voluntary Carbon Market, which are fundamentally different. In some areas, the Voluntary Carbon Market even differentiates regionally and is too fragmented to enable global cooperation. Certificates, representing the value of the investment, are often traded manually “over the counter” as PDF files. Then, an email is dispatched with the attached file and recorded somewhere in a company’s Excel sheet that seeks to perform carbon offsetting. This process is too lengthy and costly, with many intermediaries or brokers trading these certificates and continuously levying new fees. Ultimately, it becomes unclear how the price of an asset is formulated and how much of the available capital truly flows into a climate project.

A blockchain can render all these systems more transparent, secure, open for 24/7 trading, and cost-effective. This added value is yet to be seen in the traditional financial world. When tokenizing climate assets via the blockchain, ESG data can be stored as metadata within the tokens. The vastness of metadata about the underlying project simply cannot be captured in a traditional PDF file.

Philipp Misura: Where do you envision the future of sustainable investments in five years?

Nadine Wilke: Predicting the future always poses a challenge, akin to gazing into a crystal ball. However, I am confident that the tokenization of real-world assets will continue to evolve. There are already studies suggesting that by 2030, assets worth up to 16 trillion dollars will be represented through tokenization, with blockchain serving as the underlying infrastructure. Presently, within the sustainability sector, we already have 25 asset classes such as tokenized CO2 and tokens for renewable energy certificates. These also include Circular Economy, Supply Chain Traceability, and Water Credits. Established assets like rare earths, raw materials, and precious metals such as gold and silver are already being depicted and traded as their virtual counterparts, or “Digital Twins”. Ultimately, any asset that can be quantified has the potential to be tokenized.

The insightful discussion with the ReFi specialist unveils:

The marketplace for sustainable, digital assets is swiftly expanding and gaining more transparency. An amplified competitive environment, alongside the rise of FinTechs and technologies such as blockchain and AI, can play a substantial role in fostering trust in ReFi, and consequently, exert a positive long-term effect on climate protection. In my upcoming blog post, I will continue my conversation with Nadine to explore Particula’s mission and the hurdles they face in constructing their pioneering data and rating platform.

The interview was conducted in German and subsequently translated.

Contact the author

Philipp Misura

E-Mail: Philipp.Misura@horn-company.de

Contact the author

Nadine Wilke

Co-Founder & CGO, Particula

https://particula.earth/en/