The ECB Launches the Second Phase of the Digital Euro

Status Quo – Digital Euro

The first investigation phase of the digital Euro has been successfully completed, and the ECB Council has decided to start the preparatory work for the possible introduction of a digital Euro, marking a significant step towards a digital Euro for Europe. Since November 2023, we have been in this second investigation phase, which is expected to last until the fourth quarter of 2025. This phase will not only finalize the rules for using the digital Euro but also conduct extensive pilot testing to determine how a digital Euro can be efficiently managed and operated. It aims to meet both the regulatory requirements of the Euro system and the growing digitalization needs of users. Specifically, the ECB has set a series of requirements and goals for the digital Euro, including guiding principles such as data protection, accessibility, security, and efficiency in payment transactions.

In this blog post, we focus on two key aspects: the remuneration model and the wallet solution for the digital Euro. We analyze how banks can generate revenue in the future concerning the digital Euro through various services. Then, we compare these activities with the European Payments Initiative and its efforts to develop a Europe-wide wallet solution.

It is important to emphasize that our analysis focuses exclusively on banks as providers of the digital Euro wallet. However, the ECB has clarified that all Payment Service Providers (PSPs) can act as intermediaries and offer a wallet. Therefore, the following elaborations are generally applicable to other PSPs as well.

The Digital Euro Wallet and the Compensation Model for Standard Services

The digital Euro Wallet represents a crucial interface in the ecosystem of the digital Euro, as it provides end customers with direct access to various services (frontend solution). It is not only a tool for daily financial interactions, such as checking account balances or conducting transactions, but also the primary customer interface through which users can interact with the comprehensive features of the digital Euro (e.g., smart contracts). Those interested in learning more about the functionality of the digital Euro should take a look at our publications on “Retail-CBDC” and “Wholesale CBDC“. The finished wallet is intended to be offered flexibly, both in digital form on smartphones and physically in the form of a card (similar to a checking or debit card), thus facilitating access and use of the digital Euro for a broad user base.

In the context of this user-friendliness, the European Central Bank has made it clear that certain basic services classified as standard services will be free of charge for private end customers. Through this measure, the ECB aims to achieve high acceptance and establish a strong trust in the digital Euro as a secure, efficient, and accessible form of digital payment. This policy of cost-free services signals the ECB’s clear commitment to promoting an inclusive digital economy, where the digital Euro is established as a universal and user-friendly means of payment, analogous to today’s cash.

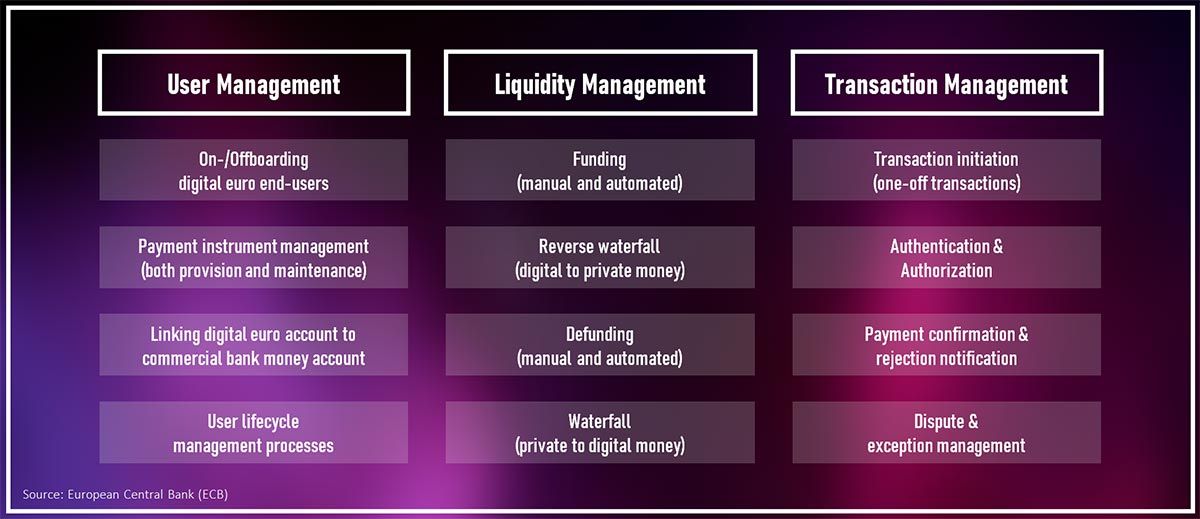

The fee-free standard services for private end customers include essential aspects of user management, such as onboarding (the registration and setup of new users) and offboarding (the closing of accounts), as well as basic functions in liquidity and transaction management. The latter includes the manual or (semi-)automated exchange of Euro cash into digital Euro and the processing of transactions essential for the everyday use of the digital Euro. The following graphic summarizes the standard services by category (User Management, Liquidity Management, Transaction Management).

In contrast to private end customers, the guidelines of the ECB for business users, such as companies and merchants, allow banks to charge fees for the provision of standard services. This regulation gives financial institutions some leeway to generate revenue. However, the ECB has also made it clear that these fees must be in line with the cost structures of other comparable electronic payment methods and must not exceed them.

The Digital Euro Wallet as a Business Model

The opportunities to generate revenue by providing a digital Euro Wallet are limited. However, this applies in a narrower sense only to the mentioned standard services. In a broader sense, additional services can be individually priced for both private end customers and commercial end customers. In the following, we present some potential value-added services that could be offered in relation to a digital Euro Wallet:

- Integration of additional digital currencies and assets: A digital Euro Wallet could act as a universal wallet for various cryptocurrencies, like Bitcoin or Ethereum, or other tokenized assets. This would allow users to manage different digital currencies in a single, secure, and convenient portal. However, this idea requires a crypto custody license, as the custody and trading of cryptocurrencies are subject to strict regulatory requirements.

- Credit offers and financing models: The wallet could offer mini-loans directly in digital Euro to initiate larger transactions without the automatic exchange of fiat money into digital Euro. Especially considering the discussed holding limit of 3,000 digital Euro for private customers, this service could generate additional value. [1] Furthermore, buy-now-pay-later options and flexible financing models could be integrated to provide users with additional liquidity and payment flexibility.

- Extensions for digital identity and payment documents: The wallet could serve as a central platform for various digital documents and IDs, simplifying the management of users’ digital identities. This could include passports, driver’s licenses, membership cards, or even digital keys (Smart Home).

- Analysis services in cooperation with other companies: By analyzing payment flows and user behavior, personalized financial advice, spending trends, and saving potentials could be identified. These analyses could also be conducted in collaboration with other companies to gain deeper insights into customer data and create targeted offers.

- Additional security services for businesses and merchants: Given the growing importance of cyber security, specialized security services could be offered. These could provide enhanced protection against fraud, data breaches, and other security risks, which could be particularly interesting for business customers.

- Participation in or offering of loyalty programs: Integrating loyalty or reward programs into the wallet could provide an incentive for frequent use. Customers could collect points or rewards for transactions and redeem them for discounts, special offers, or other benefits.

These value-added services offer not only additional sources of revenue but can also help increase customer loyalty and make the wallet more attractive to a broader user base.

The European Payments Initiative (EPI) – An Alternative to the Digital Euro in Europe?

The European Payments Initiative (EPI) represents a significant development in the European payments space, as a consortium of European banks and financial service providers aims to establish a unified, pan-European payment method. It focuses on introducing its own wallet, named “Wero,” which is built on the SEPA Instant Payment infrastructure and is intended to support both online and offline transactions. Technically, the EPI wallet resembles the digital Euro in some aspects, particularly in the use of QR codes for initiating transactions.

The ECB, for its part, has shown ambitions not only to provide the technical infrastructure for the digital Euro but also to develop its own frontend. This raises questions about the impact on commercial banks that are simultaneously supporting the EPI. Initially positioned somewhat critically against the digital Euro, the EPI is now showing some willingness to cooperate, aiming to realize potential benefits from collaboration with the ECB.

Banks involved in both the EPI and the digital Euro project face the challenge of potentially having to provide multiple frontends: one for traditional online banking, one for “Wero,” and another for the digital Euro. The EPI is trying to address this situation by bringing its wallet solution to the market as quickly as possible, next year, to establish its own wallet as the standard as a first mover. Whether and how an integration of the digital Euro into the EPI wallet might occur, and whether there will be separate wallet solutions, is currently unclear.

Overall, this situation reflects the prevailing uncertainty and complexity characterizing the future of the payment landscape in Europe. Both the EPI and the digital Euro have the potential to strengthen European autonomy in payments and improve efficiency. However, the question of the integration and interplay of these two systems remains an open and challenging task.

Conclusion – The Digital Euro Wallet as a Strategic Positioning

Financial institutions that want to offer services around digital assets and payment solutions should engage early with the digital Euro and its implications for their payment transactions. The continuous development of the digital Euro should always be monitored to identify potential benefits and prepare adjustments to the traditional business model. In particular, the three core areas of user, liquidity, and transaction management will need to be addressed in the future.

Do you have specific questions about the EPI or the digital Euro?

Our experts at Horn & Company are available to personally discuss the implications for your business model. Contact us today to learn about your opportunities in the field of digital assets and payments.