Rise of the Virtual Real Estate

#HornAndCompany #VirtualRealEstate #Blockspace #Decentraland #Metaverse #NFT #DigitalAssets

In the Metaverse, there is a dedicated real estate market that revolves around virtual land, buildings, and properties. These virtual properties are often traded as Non-Fungible Tokens (NFTs) on blockchain platforms. As we explained in our previous blog post, NFTs are unique digital assets that represent ownership and authenticity of virtual items or properties.

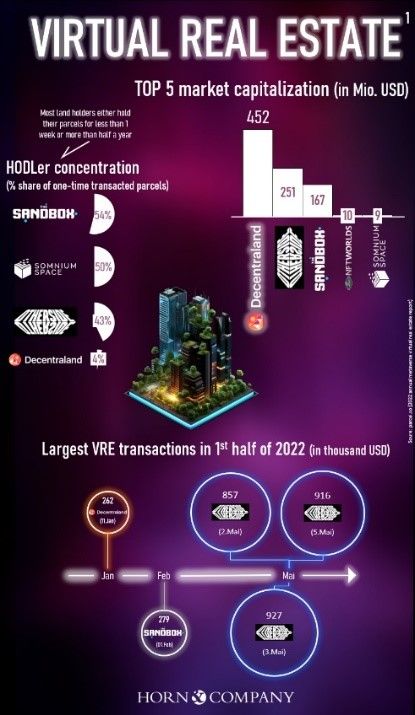

HIGH MARKET CAPITALISATION IN VIRTUAL WORLDS

Popular virtual worlds such as Decentraland, Otherside or Sandbox have a market capitalisation in the three-digit million range offering users the ability to buy, sell, and rent virtual land. Furthermore, these lands can be further developed and customized according to the owners’ preferences. Prices for virtual properties in the Metaverse can vary significantly and depend on several factors

ATTRACTIVE LOCATION

Similar to the physical real estate market, location plays an important role. A property in a popular virtual world or a highly frequented area may be more desirable than a secluded one. Popular virtual worlds attract more users, increasing the attractiveness of properties in those areas.

USAGE AND DEVELOPMENT PLANS

The options for design and use of virtual land can vary. A property with enhanced customisation options or special features may have a higher value than a simple plot. The development of neighbouring properties can also increase the value of a specific land, as it enhances the potential for social interactions and collaboration.

REPUTATION AND FAME

In some cases, value of a virtual property can increase based on the reputation or fame of the owner. If a well-known personality or reputable organisation owns or conducts activities on a virtual property, it can enhance the value and attractiveness of the land.

SCARCITY

When demand for virtual land exceeds supply, prices can rise. This can occur when a virtual world offers limited space or when specific areas are particularly sought after, such as near virtual attractions or community centres. Regarding Decentraland, we would like to delve a bit deeper into the last factor:

LIMITED BUT COVETED: LAND PARCELS IN DECENTRALAND

Decentraland limits the available land through the introduction of a fixed grid system called “LAND parcels.” These LAND parcels are individual virtual properties, each with a specific size and shape. Decentralands` grid system divides the virtual world into a total of 90,601 LAND parcels, each measuring 10 meters by 10 meters, covering approximately 9.1 million square meters. Each parcel can be acquired by a user and customized according to their preferences.

Users have the freedom to use and develop their parcels individually, whether for building structures, designing landscapes, or setting up virtual attractions. The purpose of limiting the parcels is to create scarcity and maintain demand for the LAND parcels. It is important to note that the total number of LAND parcels in Decentraland is currently fixed, but there are plans to expand the platform and introduce additional features and content in future. This means that additional parcels may be added to encourage further development and interaction in the Metaverse.

THE FUTURE OF VIRTUAL REAL ESTATE

The big question here is what this means for current parcel owners. Does the increased supply diminish the value of their virtual real estate investments? Or will a process similar to a capital increase be implemented for these investors? Despite this unresolved question, sought-after virtual land already commands high prices. For instance, a user paid around $450,000 for a plot adjacent to the world-famous musician Snoop Dogg. Such headlines have raised concerns about the possibility of a virtual real estate bubble.

CONCLUSION: INVESTMENT IN VIRTUAL REAL ESTATE REMAINS RISKY

The Metaverse is not immune to the forces that cause bubbles in the real world. Speculation, hype, and FOMO (fear of missing out) can drive up the prices of virtual properties even if there is no underlying value supporting it. Accordingly, virtual real estate should still be considered a high-risk investment.

Image source and further info: parcel.so (2022 annual metaverse virtual real estate report)

DO YOU HAVE SPECIFIC QUESTIONS ABOUT VIRTUAL REAL ESTATE?

Our experts at Horn & Company are available to discuss your individual strategy in the virtual real estate market in person. Contact us today to learn about your opportunities in the emerging metaverse.