Regenerative Finance – High-quality data and blockchain contribute to increased transparency

#ClimateFinance #RegenerativeFinance #ImpactInvesting #Blockchain #CarbonAssets #Web3 #DigitalAssets

Following Decentralized Finance (DeFi), Regenerative Finance (ReFi) is already emerging as another trend in international financial markets. In this rapidly expanding ecosystem, FinTechs are leveraging blockchain technology to tokenize sustainable assets and make them tradable. We shed light on specific characteristics and ongoing developments in this nascent segment in detail in our ReFi blog post.

The tokenization process in the ReFi sector gives rise to new digital financial instruments for sustainable assets like the tokenization of CO2. These are characterized by transparency and high data quality, setting new standards for impact investing. However, the data landscape remains cluttered, making it challenging to comprehend how investments in digitized sustainable assets genuinely impact the climate.

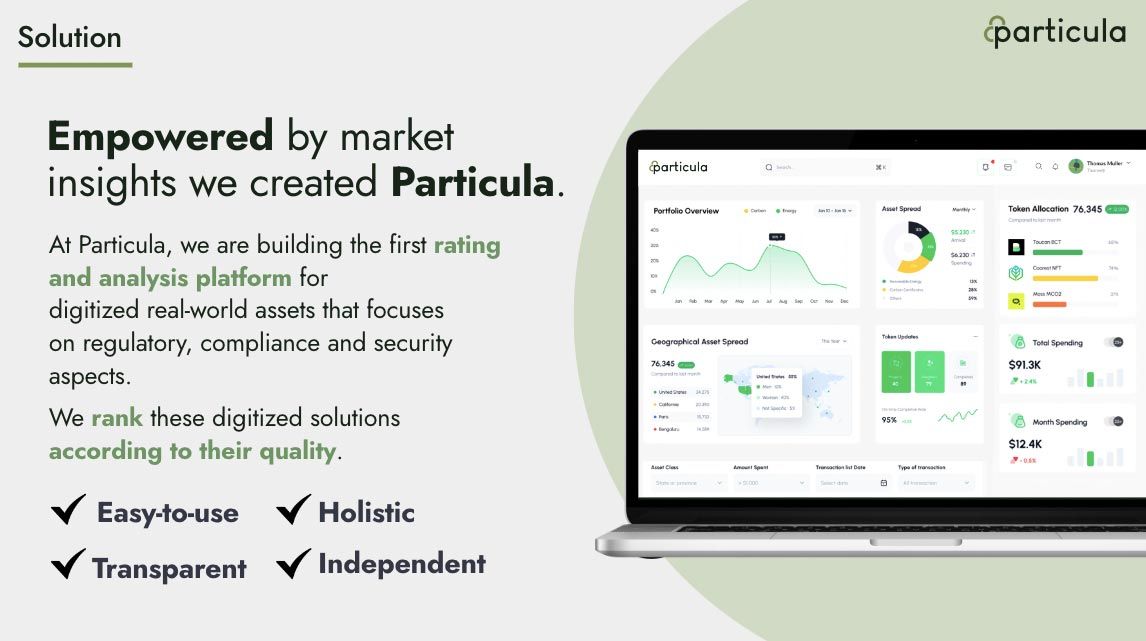

The Munich-based FinTech, Particula, is developing a comprehensive, automatically generated data and rating platform for tokenized real-world assets. Positioning themselves as the “Moody’s for tokenized assets,” the founders aim to enhance transparency in the sector and provide investors and companies with a solid foundation for their investment decisions. In our interview, Particula co-founder Nadine Wilke expounded on their unique business idea and their approach to their work.

Philipp Misura: With Particula, you are already firmly embedded in the ReFi movement. What do you envision as your mission, and how do you plan to accomplish it?

Nadine Wilke: Our mission with Particula is to make the market for tokenized assets more understandable and accessible for professional investors. We focus primarily on harmonizing asset specifications and providing a reliable information platform that gives investors valuable insights for their due diligence, compliance, and risk assessment processes.

In this context, the field of Regenerative Finance, with its dynamically growing adoption rate, offers us an excellent entry point from both the issuer and customer perspectives.

Especially in the voluntary carbon market, blockchain as infrastructure and the integration of further emerging technologies such as AI (Artificial Intelligence) or IoT (Internet of Things) can increase transparency, liquidity, and traceability. The increasing digitization of trading reduces information asymmetries and achieves efficiency gains.

Since this is well received in the industry, a lively ecosystem of various providers has developed who are involved at different points in the value creation of a certificate. This value chain typically starts on the customer side with providers who assist companies in determining their respective CO2 footprints and on the issuer side with project developers in Asia, South America, or Africa who develop corresponding compensation projects. What follows is the auditing and verification of the project and the bound or absorbed amount of CO2 and the subsequent issuance of a CO2 certificate representing 1 ton of CO2.

Tokenization providers take over the technical implementation of the digital representation on the blockchain. At the same time, an increasing number of project developers are integrating specialized DMRV providers (“Digital Measurement, Reporting & Verification”) that open up new data sources through the use of satellite images or remote sensors.

Ideally, this collected data is automatically and in real-time transferred transparently and immutably to a corresponding blockchain ecosystem for project validation. This, of course, represents a gain compared to the opaque and inefficient existing certificate trade.

We see further applications for the integration of blockchain in the sustainability sector with any type of impact certificates (biodiversity, water, plastic), in the field of renewable energies, with project financing for wind parks or solar installations, in the field of precious metals, rare earths, or impact investments through structured products such as bonds or funds.

However, as the example above quickly shows, the amount and complexity of data increase with technological integration. At the same time, there are new implications regarding the regulatory treatment, custody, and trading of these new financial instruments. This also increases the need for specialized data providers.

Philipp Misura: You also refer to yourselves as the “Moody’s for tokenized real-world assets”. Could you elaborate on this and describe what your product looks like?

Nadine Wilke: Our platform’s architecture mirrors that of conventional rating and data providers like Moody’s, Sustainalytics, or Bloomberg, embodying a blend of Web3 content on a Web2 tech stack.

Customers can locate tokens on our platform, sift through and juxtapose them, and access their respective ratings. We evaluate tokenized assets, focusing on their technical, economic, environmental, and compliance facets.

Beyond carbon tokens, we currently offer token data from 25 asset classes. While our main emphasis is on alternative investments at the intersection of sustainability, we envisage rating all tokenized assets in the future, including, for example, equity in real estate. To achieve this, we amass data from openly available sources and maintain close collaborations with issuers for data collection.

Our business model is based on the traditional subscription format. Additionally, we license our ratings for utilization on external marketplaces, exchanges, or through the issuers’ distribution channels.

Philipp Misura: Who are the main consumers for your data platform? Who could be your prospective customers?

Nadine Wilke: Our principal target audience is within the financial services sector. We specifically cater to crypto asset providers and crypto hedge funds aspiring to broaden and diversify their business segments. We assist them in pinpointing novel, high-quality tokens. Concurrently, we observe a consistent interest from marketplaces and exchanges seeking to elevate their investment vehicles’ credibility via our ratings. We also foresee potential with conventional asset managers, with whom we are currently in discussions to better comprehend their specific information needs. Companies already utilizing tokenized vehicles for offsetting consistently show interest in our products. Given the tightening of disclosure and reporting obligations, we anticipate demand in this customer segment to steadily rise in the forthcoming years.

Philipp Misura: Given the prominence of greenwashing, reputation and data quality hold central importance in the ESG sector. How do you procure your data, and how is its quality assured?

Nadine Wilke: This indeed poses a challenge. At present, we manually aggregate some data and through bilateral communication with issuers. This naturally necessitates extensive discussions and analyses. We also employ data scrapers to access publicly available databases and obtain information directly from websites and blockchains, particularly from the respective block explorers.

Our ambition is to fully automate these processes in the future. There are already providers with robust data repositories, but the quality is vastly inconsistent. Especially in nature-based solutions like forest conservation or reforestation, data collection is particularly challenging. Conversely, with technology-based solutions like biochar, the data foundation is robust thanks to solutions that directly read out CO2 storage and can be transferred to the blockchain in real time.

Traditional players like Earthood certify projects on-site based on existing quality standards and criteria. Verification bodies like Verra and Gold Standard not only monitor compliance with standards and criteria but also verify the existence and execution of a project. These controls reinforce the project’s credibility and transparency.

However, Verra has recently faced criticism for awarding excessive CO2 certificates for reforestation projects, resulting in overestimated project impacts. This underlines the existing inefficiencies in the traditional market and the necessity to integrate new technologies like blockchain, AI, and IoT to foster required transparency and trust.

Philipp Misura: Who do you perceive as competitors in the market for platform-based ratings and analyses? Other startups and fintechs, or established players like MSCI or Morningstar with Sustainalytics?

Nadine Wilke: In our dialogue with established rating providers, we’ve learned of their significant interest in our business model. Yet, the conventional industry lacks expertise in this realm. Contrary to their evaluations of companies based on creditworthiness or ESG criteria, we focus on tokens as comprehensive financial instruments representing rights to real assets. These two methodologies are not directly comparable.

Conversely, there are startups operating in similar fields, such as cryptocurrency valuation. The functioning of the crypto market undoubtedly requires multiple data platforms and rating providers. Therefore, we don’t perceive rising competition as a threat, but as an enhancement. It demands considerable efforts to aggregate data in this dynamic and burgeoning industry and develop a complex rating algorithm. The competitive advantage we’ve amassed here is substantial.

Philipp Misura: What resources are you currently in need of to continue your growth? Developers, investors, or influencers?

Nadine Wilke: We’re preparing to structure our next funding round in the third quarter of 2023. In this pursuit, we’re actively engaging with potential lead investors from the finance industry and are open to extending our network. Moreover, we’re currently spearheading an initiative called ReFi-Talents in collaboration with the Frankfurt School Blockchain Center. It’s an 18-week training program at the intersection of sustainability and Web3, for which we are eager to bring on additional sponsors and participants.

To refine our products and gather essential feedback, we also provide prospective users with the opportunity to test our platform.

The essence of our conversation captures the pioneering spirit that’s prevalent in the ReFi sector. Both the infrastructure and financial instruments are still under development, while the landscape and quality of data for sustainable investments show significant diversity. The advent of new technologies, high-calibre datasets, precise and independent ratings, and lastly, an intensified regulatory environment, hold the promise of reinforcing trust in ReFi and innovative financial products. Furthermore, these developments can enhance the efficiency of directing investments towards significant climate projects.

The interview was conducted in German and subsequently translated.

Contact the author

Philipp Misura

E-Mail: Philipp.Misura@horn-company.de

Contact the author

Nadine Wilke

Co-Founder & CGO, Particula

https://particula.earth/en/