The strategy of the European Central Bank for the future of retail payments

On the 22nd November of last year, the European Central Bank (ECB) published an update of its retail payments strategy. It sets out the ECB’s strategic approach to modernizing and developing the retail payments market in Europe. The strategy was first developed in 2019 and later expanded in 2020. The now published updated version of the strategy is the roadmap for the ECB’s work on retail payments in the coming years.

The topic is relevant for all market participants providing payment services in Europe as it sets out the expectations to be met and the support to be provided. First, the strategy assures banks and payment service providers (PSP) of the ECB’s support for the development of pan-European payment solutions. Second, the strategic objective of strengthening the classic SEPA has a strong influence on implementation and development efforts of banks and PSPs. Third, additional resilience requirements for retail payments demand additional investments and efforts to meet them.

This article provides an overview of the strategy and examines the potential impact on the banking industry.

Key objectives of the strategy

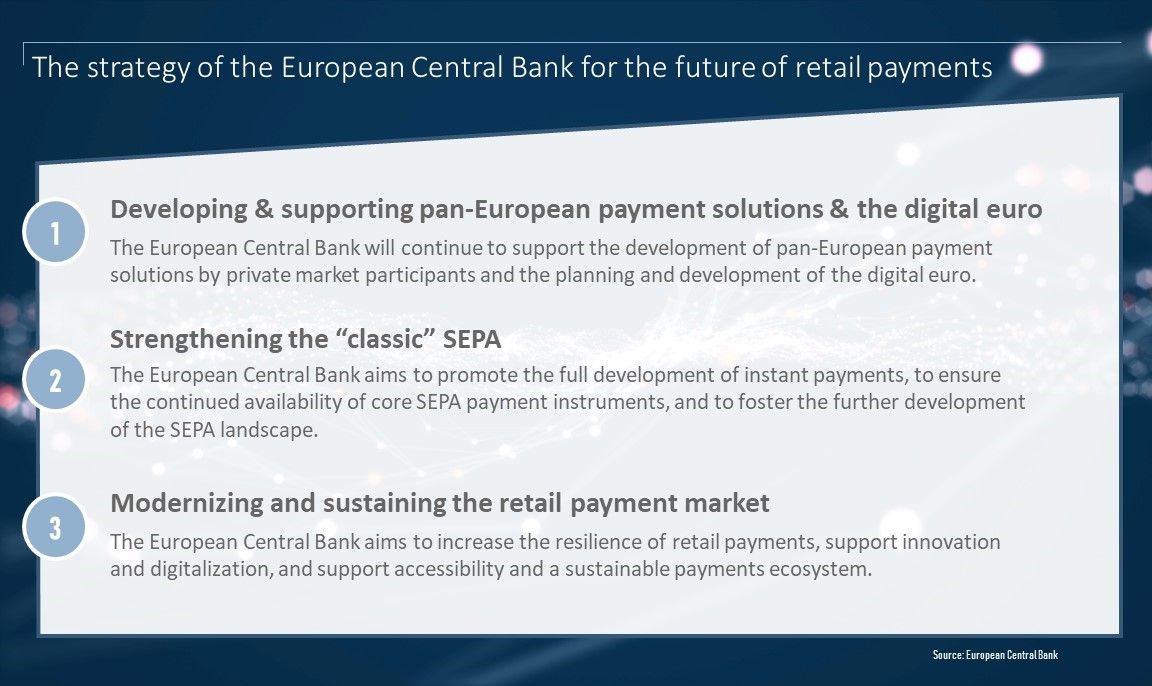

The updated strategy is based on three key goals. The following illustration summarizes these goals:

1. Developing & supporting pan-European payment solutions & the digital euro

The updated strategy emphasizes the importance of developing and promoting pan-European payment solutions as there is currently no pan-European solution for point-of-interaction (POI) payments. The ECB argues that current retail payment methods are heavily dependent on non-European payment schemes and solutions, e.g. card payment infrastructure from Visa or Mastercard. Therefore, the ECB plans to further support market-led initiatives in their development, provided that they meet five key objectives:

- Pan-European reach & customer experience

- Convenience & low cost

- Security & efficiency

- European brand & governance

- Long-term global acceptance

One of these initiatives is the European Payments Initiative (EPI), which aims to develop a payment solution for consumers and merchants across Europe. The ECB also discusses the importance of the digital euro to support the growing number of digital retail payments in Europe. At the same time, the ECB points out that its central digital euro is unlikely to crowd out private pan-European retail payment solutions due to the growing number of digital retail payments.

2. Strengthening the “classic” SEPA

The second objective of the updated strategy is to further strengthen SEPA in Europe and, potentially, beyond. To achieve this goal, the ECB aims to promote the adoption of the SEPA instant credit transfer scheme (SCT Inst) and to future-proof existing SEPA schemes, such as the regular credit transfer scheme (SCT) and the direct debit schemes (SDD Core and SDD Business-to-Business). Therefore, the ECB is focusing on 3 main actions:

- Encouraging the full deployment of instant payments: The ECB will continue to promote the non-discriminatory introduction and widespread use of instant payments, which allow the immediate transfer of funds between accounts throughout the euro area at attractive conditions for end users. Additionally, the ECB plans on ensuring availability of specific pan-European functionalities supporting the provisioning of end user solutions, such as SEPA Request to Pay (R2P).

- Ensuring the continued availability of core SEPA payment instruments: The ECB will work to ensure that traditional SEPA payment instruments, such as the SEPA credit transfer and the SEPA direct debit, remain widely available and accessible to consumers and businesses in order to maintain continuity. In addition, the ECB will work with market participants and relevant authorities to promote compliance with SEPA rules and standards and to ensure their consistent as well as harmonized implementation across the euro area, thereby enhancing the SEPA payment landscape and making it more seamless and interoperable.

- Promoting the evolution of the SEPA landscape: The updated strategy recognizes the European Payments Council’s additions to the SEPA landscape, such as SEPA Payment Account Access (SPAA) for more freedom to choose a payment solution at the POI, and One-Leg Out Instant Credit Transfer (OCT Inst), a new cross-border and cross-currency SEPA scheme that allows even more payment solutions to be used for international payments.

3. Modernizing and sustaining the retail payments market

The third objective of the updated strategy is to modernize and maintain the existing retail payments market. In order to achieve this objective, the ECB focusses on three key points:

- Enhancing the resilience of retail payments: Recent external developments have increased the need for improved cyber resilience of retail payments. Therefore, the ECB aims to improve resilience by ensuring the availability of fallback options in the event of network unavailability or disruption. This can be achieved by having different payment systems that do not rely on the same technology, allowing consumers to switch payment solutions if necessary. At a more specific level, the resilience of each payment solution needs to be addressed, for example by including offline capabilities.

- Supporting innovation & digitalization: The ECB plans to further support innovation and digitalization by promoting competition through providing a level playing field for all market participants. In addition, the ECB emphasizes the integration of other existing market initiatives, such as the electronic identity (eID) and electronic signature (eSignature) services, to further develop payment services – allowing banks the opportunity to approach new business areas by offering “trust services”.

- Promoting accessibility & a sustainable payments ecosystem: With the shift towards more and more digital transactions, the ECB will explore the possibility of studying the environmental footprint of electronic retail payments to enable comparisons with euro banknotes. Moreover, the ECB recognizes the increasing shift towards digital payment methods, combined with the decline in cash acceptance, and raises concerns about the ability of more vulnerable people to make payments.

Impact on the banking industry

In general, the updated strategy does not formulate completely new objectives for the future of the European payments market. However, it does have some implications for banks and financial institutions.

SEPA instant payments

With regard to SEPA, banks are expected to adopt the SCT Inst payment scheme and offer it to all customers at a cost no higher than that of traditional credit transfers, if they have not already done so. This is also underlined by the European Instant Payment Regulation, which aims to make instant payments available to all citizens while being affordable, secure, and processed without obstacles. The final version of the regulation is expected to be published in the first half of 2024. Once the regulation enters into force, banks will have 9 months to ensure compliance for receiving SCT Inst and 18 months for sending SCT Inst. Non-bank payment service providers will have 36 months to ensure compliance for sending and receiving SCT Inst.

This regulation has some implications for banks with respect to the implementation of SCT Inst and business case for offering it:

- Banks are required to implement the new technology at their own cost (incl. cross-border interoperability). A rulebook for implementation outlining the requirement to be met does exist, however, the cost to implement the technology must be covered by each bank themselves.

- Banks are required to develop a SCT Inst product for their product portfolio (incl. an efficient chargeback process). Prior to the technical development, the business department must design new and efficient processes for SCT Inst, allowing payment processes to flow within the company.

- Banks are required to offer SCT Inst transactions at attractive costs to end users. The cost of an SCT Inst transaction is expected to not exceed the cost of a “normal” credit transfer, thus, limiting possibilities in charging premiums for additional services.

- Banks are required to prepare for a shift in customers’ payment behavior and product usage as the introduction of a SCT Inst might impact the overall product portfolio and require additional payment product introductions (e.g. R2P).

As a result, banks need to develop a new overarching payment strategy with a new revenue-generating fee model to be able to offer customer-centric products.

New SEPA instruments

The implementation of new SEPA developments, such as the OCT Inst scheme, requires additional investments from banks, but would broaden the product portfolio. However, it may also be a strategic decision to be a first mover, to be one of the first banks to offer this type of service. But instead of making small-scale tactical decisions, however, this should be the subject of a comprehensive, long-term payment strategy which considers all the corresponding (financial) advantages and disadvantages.

New resilience requirements

The ECB’s additional resilience expectations require changes to existing structures and therefore additional investments to meet the extended requirements. Depending on the individual situation, these investments may include the introduction of an alternative payment method and an offline functionality for customers affecting the profitability of banks’ payment offering in the future.

The digital euro

The strategy also includes the ECB’s ambition to introduce the digital euro as a central pan-European payment solution. Assuming a positive decision on the digital euro in 2025, this could lead to increased investments by banks and PSPs to implement and support the digital euro in the coming years. This decision must also be assessed in the context of all available payment methods and the possible impact of the digital euro on these. We have already discussed in another article the opportunities that a digital euro could offer and the services that banks and PSPs could provide.

Do you have questions regarding your retail payments strategy?

Banks have opportunities to set-up new profitable offerings and business models, instead of waiting for upcoming regulations affecting banks’ current positioning negatively. Our experts at Horn & Company are available to discuss the impact on your individual portfolio, business, and the opportunities arising from the updated strategy. Contact us today to explore and prioritize your opportunities in the changing retail payments market.

Contact the autor

Leon Heyn

Send e-mail

Contact the author

Martin Rupprecht

Send e-mail

Your gateway to industry knowledge and expert analysis! Follow us on LinkedIn for exclusive professional articles and project insights.