From Bitcoin to Digital Euro – A Guide for the Regulation of Digital Assets

#krypto #micar #digitalereuro

Anyone who has been following the prices of cryptocurrencies recently gets a sense for the importance of regulation in the field. News about a possible approval of Bitcoin ETFs in the United States has caused prices to skyrocket or plummet within minutes in recent weeks.

Changing legislation has become one of the strategic key aspects for the adoption of blockchain applications in financial markets. On the one hand, there is a potential risk that services provided may become illegal or too expensive due to new legal requirements. On the other hand, improved legal certainty can pave the way for the mass adoption of digital assets by large retail banks and institutional investors.

In the European Union, digital assets or cryptocurrencies fall under three major regulatory regimes depending on their characteristics: 1) MiFID II for digital assets with securities characteristics, 2) MiCAR with regulations for private cryptocurrencies, and 3) the recently released legislative package of the European Commission, along with ongoing ECB plans for the digital Euro. These three legal frameworks are discussed in detail below.

MiFID – Digital Assets with Securities Characteristics

The Markets in Financial Instruments Directive (MiFID) regulates securities services in its current form since 2018. In Germany, BaFin examines whether cryptocurrencies or related services (e.g., Initial Coin Offerings) qualify as financial instruments under MiFID on a case-by-case basis. To classify a digital asset as a security, it must meet certain criteria, including transferability, tradability in the financial market, and the potential embodiment of rights (e.g., shareholder rights or contractual claims). Services related to such assets require permission from BaFin.

DLT Pilot Regime – Exceptions from MiFID

Since March 2023, there have been several exemptions for blockchain/DLT applications from MiFID obligations for trading systems, market operators, and central depositories. The “DLT Pilot Regime” follows a “sandbox approach” with exceptions based on volume limits – for example, simplified legal requirements for DLT-based stock issuances only apply to market capitalizations of up to 500 million euros.

German Electronic Securities Act (Gesetz über elektronische Wertpapiere)

With the Electronic Securities Act, Germany has established the legal basis for issuing securities based on the blockchain technology. Electronic securities are now equivalent to paper-based certificates (property law; “Sachenrecht”). Currently, the regulation only applies to bearer bonds, mortgage bonds, and certain special funds, but an expansion to include stocks is planned as part of the Future Financing Act (“Zukunftsfinanzierungsgesetz“). Since then, the issuance of new securities, including all performance promises, can be recorded in an electronic register without the previously required physical documentation. The entry can be made in a central depository’s register or in a crypto securities register with decentralized recording (such securities are then referred to as crypto securities).

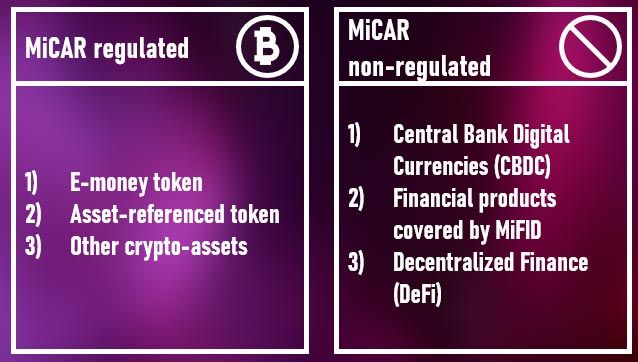

MiCAR – Crypto Assets outside of MiFID

In the European Union, the focus has recently been on the Markets in Crypto Assets Regulation (MiCAR/MiCA Regulation), which officially came into force in June 2023. MiCAR regulates cryptocurrencies that do not fall under MiFID. In particular, asset-referenced tokens and e-money tokens (Stablecoins), which achieve value stability by referencing official currencies or other assets, have received a clear legal framework for emission and secondary market services through MiCAR. (Horn & Company recently conducted a detailed examination of MiCAR – see here)

Regulatory Plans for the Digital Euro

In June 2023, the European Commission published draft for regulation on the digital Euro. This lays the foundation for the introduction of Central Bank Digital Currency (CBDC) within the Eurozone. We have already written an article on the possible benefits of a digital Euro.

The Commission is responding to the trend that central bank money in physical form (cash) is losing importance in an increasingly digital world. Accordingly, the draft version of the law emphasizes easy usability of the Digital Euro throughout the Eurozone and its similarity to cash (e.g., in terms of privacy and offline use). The European Commission has emphasized that the Digital Euro should not be programmable money. Its use cannot be restricted or prescribed for specific goods or services, contrary to the concerns of many project critics. The proposal creates an initial official framework for the legal framework for Central Bank Digital Currency in the European Union. In parallel, the European Central Bank plans to conclude the investigation phase of the Digital Euro project by autumn 2023. Subsequently, technical solutions and business regulations can be further developed. Open questions include whether participation in the Digital Euro will be mandatory for all banks and their role in the development of front-end services. The introduction of possible holding limits is also still under discussion. Therefore, the introduction of the Digital Euro should not be expected before 2027.

Conclusion – Regulation as a Strategic Core Component

Financial institutions that want to offer services related to digital assets should consider legal framework conditions early in their strategic planning. The continuously evolving legal requirements should not be viewed solely as an additional cost factor but also as an opportunity for the business model. Established banks, with decades of experience in complying with financial market regulations, may have a competitive advantage in a more regulated market over new competitors. Furthermore, improved legal certainty enhances trust in the currently very volatile crypto market and may open up new customer groups.

DO YOU HAVE SPECIFIC QUESTIONS ABOUT THE REGULATION OF DIGITAL ASSETS AND CRYPTOCURRENCIES?

Our experts at Horn & Company in regulatory matters and the blockchain field are available as contacts with their many years of experience in financial markets to assess the latest regulatory trends and support your implementation possibilities. Contact us today to learn about your individual strategic options.